Why a Soft Landing might be possible but is not a desirable outcome

What a Soft Landing scenario would look like

Harry Dent is a bearish financial journalist and trends forecaster, who early last year, insisted that there would be an epic crash in June. In a recent interview, Dent seemed almost irate about markets taking so long to crash. Basically Dent said that if the bubble does not burst this year, he will retire from economic forecasting. The question is whether it has just taken longer for the bubble to burst, or have we entered a new paradigm where bubbles never burst and recessions never occur, which seems to be the Fed’s objective.

Bubbles never burst with a soft landing. Either there will be a crash or the bubble will be propped up longer. The Great Depression bubble was only in stocks, then there was the tech bubble, and the 08’ financial crisis which was a real estate bubble. In contrast, today is an everything bubble, including real estate, tech, and stocks.

The bullish case for a soft landing, that inflation and unemployment are simultaneously low, is idiotic. Unemployment is often low before recessions and there is a temporary window where deflationary pressures cool inflation while employers retain workers. Assuming that strong wages plus low inflation can be sustained is delusional.

The soft landing narrative has no response to unprecedented levels of debt, including government, corporate, and private debt. Not to mention the dangers of inflation resurging with the Mideast wars. So the Fed would have to raise or maintain interest rates with high levels of debt. The banking system still has major problems, though consolidation has gone smoother and has been less chaotic than bears anticipated. Regardless, there is a high risk of another banking crash, due to commercial real estate and corporations having to refinance their debt at higher rates.

Ultra bears, like Peter Schiff, see a short-term danger of the US losing its World Reserve Currency status. While the US would enter a Depression if it lost its reserve status, I don’t see that happening anytime soon. There is no clear competitor for the reserve currency, much like how monopolies can get away with ripping off customers and having awful products and services. While I am very skeptical of the proposed BRICS currency, long-term there could be a global digital currency that is not tied to any particular nation, but perhaps backed by some commodity. I could also see different geopolitical blocks with their own reserve currencies. There could be a long-term erosion of the dollar, though the dollar could strengthen in the near future. Basically Schiff is right about the long-term but wrong about the short-term.

Peter Schiff is also recommending investing in emerging markets, as the winners of a collapsing dollar. While I don’t give financial advice, that seems like terrible advice with some exceptions. For instance, nations benefiting from the decoupling from China, like Vietnam, India, and perhaps Mexico. While the global economy is set for the worst growth in 30 years, so far the US has been the outlier. This is because the US is exploiting its reserve currency status to prop up its economy at the expense of other nations.

The US could actually benefit immensely from the demise of other nations, much like it did after WWII. China and Europe are in terrible economic shape, let alone the chaos and collapse facing many Third World nations. If other nations face economic collapse or civil unrest, more foreign investors could purchase US bonds or invest in American real estate as a hedge. Plus many foreign nations need dollars to pay off their debts. Wall Street bankers and the IMF will loot collapsed Third World nations of their resources, in exchange for debt forgiveness. Not to mention America’s great energy advantage over Europe and East Asia, especially if petrol shipping routes are further disrupted in the Mideast.

Another reason that America has avoided a technical recession is that unprecedented levels of foreign migration have propped up the GDP and real estate while easing wage inflation. However, mass immigration is terrible for the quality of life for working class Americans and exacerbates income inequality. Though nations like Canada and the UK, ramping up immigration, has not saved them from entering a recession.

Basically the cycle to prop up the economy is the Fed printing, then exporting inflation abroad, but then the US brings in migrants to reduce inflation. This also applies to the recent surge in artificial intelligence, as AI increases productivity and economic growth and eases consumer and wage inflation while eliminating jobs and increasing income inequality. Things will get much worse economically for the average person, but there is a chance that we could avoid a technical recession if AI and immigration grow the GDP.

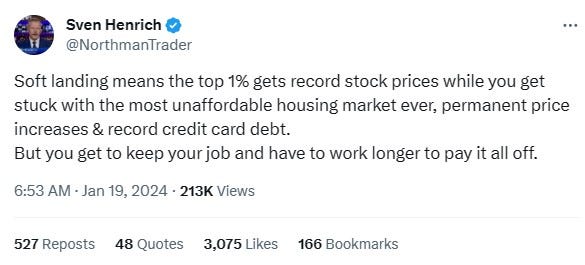

Source: @NorthmanTrader on X

In my article, No Collapse is the Real Dystopia, I discussed a scenario where the quality of life declines, but there is no real institutional collapse. A soft landing just means worse income inequality, and the continued erosion and extraction of the middle class. The Great Depression actually helped pave the way for a mass middle class society, by bringing everyone down to the same level. Though with a crash, oligarchs can consolidate wealth, by purchasing defaulted real estate, and smaller banks and businesses. I am going to play Devil’s Advocate from my usual bearish takes, and perhaps a soft landing is possible but would be an undesirable outcome for many. I still believe that a crash or hard landing is more likely, but this scenario described is a possibility. Regardless, if there is no major crash this year, it would break all existing economic rules and theories.