Even Ultra-Bear's Have Their Copes

Harry Dent predicts Mega Crash in June, followed by Millennial-lead recovery in late 2024

Harry Dent is a finance and investment writer, who has a track record of predicting economic crashes, including Japan’s bubble burst in 89’ and the 08 crash. Dent authored The Great Depression Ahead, published right after the 08 crash, predicting a much worse crisis down the road. Similar predictions about impending economic doom have been made by other financial figures, including Nouriel Roubini, Muhammed El-Erian, Michael Burry, Jeremy Grantham, Robert Kiyosaki, and Peter Schiff, though one does not need to be a genius to see that we are headed for perilous economic times. Recently, on David Lin’s financial show, Harry Dent predicted a stock market crash much worse than 08, and more like the Great Depression. Likely the largest crash of our lifetime, that will occur this June. Dent predicts an 86% crash for the S&P 500, and 92% on the Nasdaq, and that this impending crash will be 50% worse than 08, with unemployment reaching 16%, which is catastrophic.

However, Dent also predicts that this severe crash will be followed by a recovery by as soon as late 2024, or at least over by late summer of 24’ for the stock market. This prediction is actually of a fairly quick recovery, especially factoring in how severe it will be. The average length of recessions, since WWII, has been about 10 months, ranging from the very brief covid recession (two months), to the 08 crash (almost a year and a half), both of which were followed by bailouts, which will be hindered by inflation for the incoming crisis. Dent’s prediction adds up to a recession that is roughly similar in length to the 08 crash. However, it is important to point out that unemployment tends to lag the stock market, and stocks are not the greatest indicator of a healthy economy.

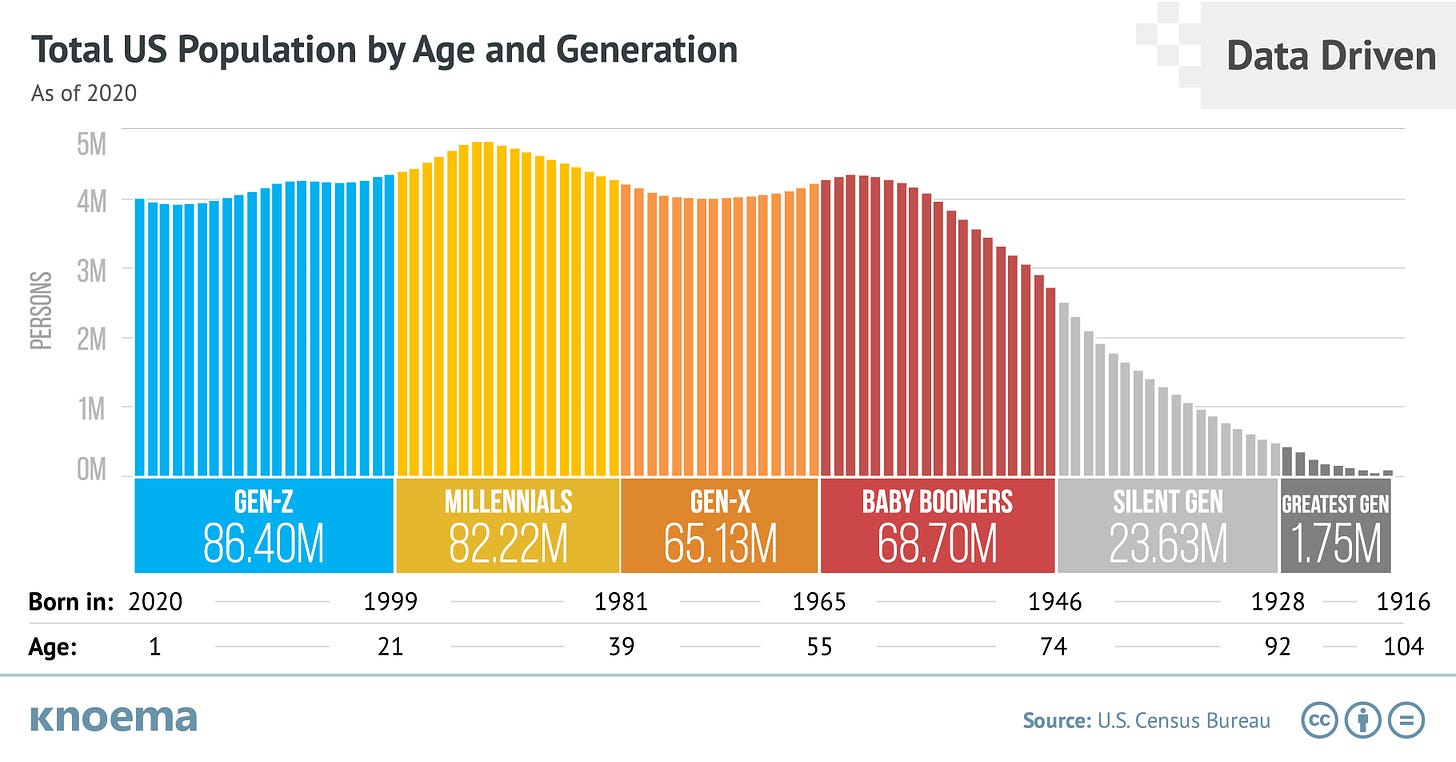

Harry Dent bases his prediction for a bust followed by a recovery on an investment thesis of spending waves, that are linked to generational demographic cycles. Demographics are what makes Dent more bullish, and he predicts a millennial boom, albeit more modest than booms for previous generational cycles, lasting from about late 2024 to the mid-2030s, with the peak of the millennial boom in the 2030s. Dent successfully predicted a crash around 2007, based upon generational cycles, while studying demographic trends for venture clients back in the early 80s. This was because the 2010s were when the baby boomer generation were in a savings cycle from early 50s to retirement age. Now the boomers are in retirement stage, and the sheer size of the boomer generation, leaving the workforce and cutting back on spending, is causing a tremendous downturn in the economy. Dent was bullish in the 80s, because of the large demographic of young boomers spending, generating economic growth. The peak in spending by age is in the 40s, so besides lower levels of debt, this may explain why the dot com crash recession was relatively mild. That was when the boomers were in their 40, and reached peak spending. Currently, the 40 something demographic are GenX, who are a smaller generational cohort than either the boomers or millennials.

Dent predicts that this future millennial boom will be based on demographics and not a bubble, and that we will not see another major bubble economy again in our lifetime. Even though Dent predicts that the next generational spending cycle will start in a year or two, it is important to clarify that he predicts a recovery by late 24’, but only if the bubble is allowed to burst naturally, to clear out excesses, and not be further propped up. However, it will likely be propped up, as we are seeing with the return to Quantitative Easing, to save the banks. This millennial boom will be compromised if the excesses of the bubble from the boomers are not cleared out first. Recessions are part of natural economic cycles that flush out zombie companies and excessive debt, and overall make economies more efficient, and create healthier bull markets. However, there is a consensus among politicians and bankers, that there should be no recessions, and that bubbles must never burst, which only creates a much worse economic crisis down the road.

Harry Dent is heavily invested in this generational theory, which does have a track record of predicting booms and busts. However, millennials are much worse off economically than previous generations, including much lower homeownership rates, and just overall much less wealth. Millennials are sinking under the weight of credit card debt, and interest rates hikes will crush those with bad debts. Not to mention that millennials have still not fully recovered from the 08 crash. While the net average millennial wealth did increase during the pandemic, that was mostly due to the segment of millennials, who are well off, and benefited from the real estate bubble. Regardless, a large portion of millennials and zoomers, could end up like Japan’s lost generation.

Dent, who is a boomer himself, predicts that this will be the biggest crisis in the baby boomers’ lives, much like how the Great Depression was for the Bob Hope generation. Despite boomers being wealthier than younger generations, Dent sees boomers getting wiped out economically, just as the youngest third of boomers are now entering retirement. He is far more worried about boomers than he is about millennials. This is because 401ks and retirement pensions are linked to the stock market. Even bonds are at risk, if the banking crisis gets worse, or if there is a sovereign debt crisis. Not to pension the potential loss of equity in real estate, interest rate hikes impacts on reverse mortgages, and inflation undercutting pensions and social security. Even now, many elderly are returning to work due to inflation. A lot of lower income and house rich, cash poor elderly, will get wiped out financially, but it is hard to say how much wealthy seniors will be impacted by the crash.

Dent makes the case that millennials, who currently can’t afford housing, could benefit from the housing crash, as well as be able to invest in real estate, stocks, and bonds, without a bubble. There is this meme of millennials, who hope for a crash so that they can afford to purchase a home, and obviously there is resentment about the intergenerational wealth divide. However, I am skeptical of a crash helping millennials afford homes, especially with the debt crisis, mass layoffs, and higher mortgage rates. Though, well off millennials, with a lot of liquid assets, will likely benefit from boomers downsizing. It is also important to point out that families are interconnected across generations and generational wealth getting wiped out is not exactly great for younger generations. Expect to see wealthy investors and private equity firms, like Blackrock, scoop up homes, and the Biden admin’s equity plan to subsidize those with bad credit at the expense of those with good credit, seems like an intentional set up to fail, to recreate another 08 housing crash scenario.

Capitalism requires population growth to generate economic growth, so monetary stimulus is a way to artificially offset the economic impacts of population stagnation and ageing. Not to mention propping up the boomer bubble, real estate assets and stocks of the old and rich, at the expense of younger generations. If there is a catastrophic pension crisis, expect more bailouts that will exacerbate inflation. This also explains why the border is being left open, to prop up the bubble, especially in real estate. Though this massive wave of migration obviously does not benefit low wage workers, or low income renters. Dent may be right, in that the sheer population of millennials, much like with population growth from mass migration, could give a boost to the stock markets and GDP, even if the quality of life for the average millennial declines.

Geopolitical analysist, Peter Zeihan, has similar theories about demographic impacts on national economies. For instance, Japan was the first major nation to have a severe baby bust, which contributed to their lost decade in the 90s. On the other hand, China, South Korea, and a number of European nations, have very low fertility, but still have enough people in their 30s and 40s, to keep their economies afloat, but will be screwed in a decade. Dent actually predicts that demographic decline will cause a deflationary crash, though one would think that an ageing population contributes to inflation, with more consumers but less workers. Rapidly ageing Japan had deflation, but that was more due to the asset bubble crash. Dent debated his prediction of deflation with Peter Schiff, who predicts an inflationary Depression, that will be much worse than the Great Depression.

There is also debate about whether an ageing demographic causes unemployment by slowing the economy, or whether it benefits the young with a tighter labor market, even with recession. Japan’s unemployment rate actually soared in the 90s, despite ageing. While there is some truth to the argument that zoomers benefit in the job market from being a smaller demographic cohort, this ignores the bubble, and unique situation with the post- pandemic reopening, including the Great Resignation. Not to mention that the sheer numbers of migrants and rise in automation, will offset any demographic benefits that zoomers have. The tighter labor market seems to be a temporary fluke, and there are already signs that GenZ will face a much tougher labor market.

Harry Dent is a smart guy and much of his analysis is spot on. However, he is so heavily invested in the generational theory which ignores other variables, including energy supply and debt. Copes about a recovery are so entrenched in finance, a need to feed hope to investors, that even the bears are not immune. In January, many Bears, including Michael Burry, capitulated over economic data that appeared bullish, even though bears have been proven right. Especially with the bank crashes, and now it looks like First Republic Bank is going to crash, and get seized by the government. Though this does not really apply to Dent, who was predicting a Depression in 2022, and I am not aware of him pivoting, such as calling for a mild recession. Even though Dent has a reputation as bearish, he is nothing like Peter Schiff, who is basically saying that we are totally screwed. Dent offers some reasons for optimism in the near future.

There is a distinction between finance bears, and the online doomer and political acceleration types, who want to see a crash, or just broader pessimism from a political or sociological standpoint. One can make money in a bear market, but it takes more skill, such as shorting stocks and buying in at the bottom. I find it hard to respect someone like Cathie Wood, who is applauded as some financial genius, when all she did was just invest at the beginning of the covid bubble. It is one thing to profit from a bubble, but there was a lot of dishonesty from the bulls, that there was an economic recovery after the pandemic, and that inflation in 2022 was just the economy heating up.

There is a difference between recession cycles and long-term downturns, which other nations have had, but the US has avoided through all of modern history. However, the signs are pointing, not to a correction, but to a deep downturn, and even many bearish figures are hesitant to acknowledge that. This is the everything bubble, that is greater than all past bubbles, that includes both a 2nd tech bubble and 2nd real estate bubble like 08. The last boom was all stimulus with no demographic or technology reasons, and we never actually finished the natural downturn from the 08 deep recession. Then trillions were printed during covid, creating another super bubble that no past bubbles can compare to, including the Great Depression. Even the roaring 20s was mostly just a stock bubble, not real estate, which will be hit the hardest, especially commercial real estate.

Good article however i think dents flaws are many for one he’s assuming the petro dollar remains the world reserve currency, in 2000 73% of world reserves were US dollars, today its around 43% and I think it was over 50% prior to the Russia invasion which means its accelerating, inviting the third world to fill up the houses of dead boomers will create horrific third world favelas throughout the us as ten migrants will live in previously one family 2000 square foot homes, I know I have a chinese friend whose parents bought a home in bensonhurst Brooklyn from fleeing boomer italians, then oncethe family was established they started bringing in 10 migrants at a time each with 100 k in cash to buy a second home and after ten years they leave and the first Chinese family gets the home, pricing out anyone with a notmal job, in the late 20th century the US was subsidized by cheap Chinese labor for goods, cheap oil from russia middle east venezuela, cheap local services utilizing Mexican labor all which subsidized the typical orange county boomer lifestyle, there all disappearing, first china will eventually stop sending cheap goods as wages have increased 10 fold since the 80’s, another factor is Xi’s desire for a local consumer economy not reliant so heavily on exports so expect far more expensive export goods, and that’s assuming we dont get into a trade war or real war with china first, south of the border Mexico’s birth rate substantially dince the 70’s barely above replacement levels, so immigrants from mexico has actually fallen in recent years, this has been replaced eith Central Americans asians Africans ect however this mass invasion will overwhelm local services, schools, housing, virtually every aspect of any local community to the point that the welfare they receive will out way any benefits they will give, automation AI, delivery services will make most low skill labor jobs redundant and will cause most of these people looking for government handouts that coupled with an ever shrinking tax paying population, California will become more and more San Franciscoized, untill it implodes, the woke technocrating totalitarian dystopia there setting up will begin to fail the moment it arises as its fundamental ideological flaws will cause cracks immediately, first it abhors meritocracy as one of it central tenets is that all humans are interchangeable widgets with no innate differences, this means maintaining a centralized surveillance state with a million shaniquas posting there delusions manning the helm would make any chinese or russian hacker salivate, the treatment of its vassels in Europe and elsewhere has shone that the GAE will destroy your country if it benefits them temporarily even if it means that by destroying your vassels you will harm yourself, as it doesn’t seem to matter as the GAE is in terminal suicidal decline as anyone who would point out that the emperor has no clothes has been purged decades ago