Vindicated About My Prediction Of A Bond Yield Spike Crashing The Economy

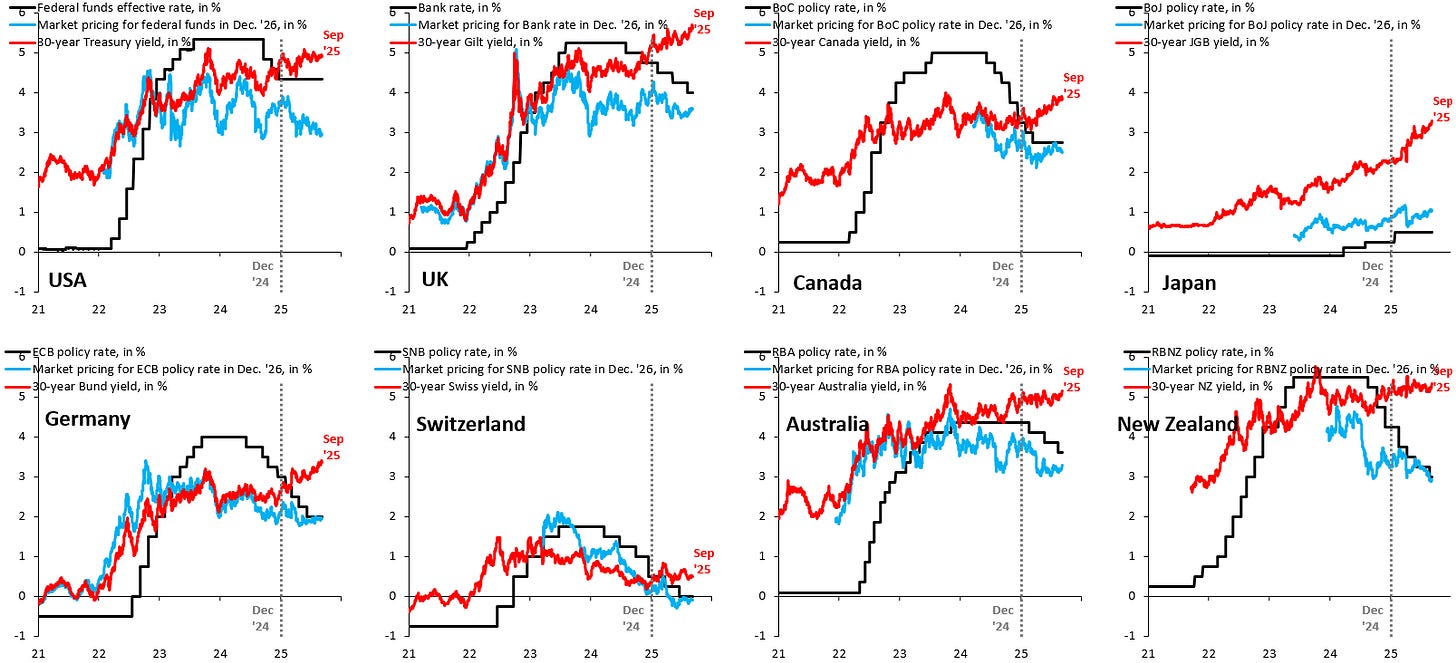

Why Bond Yields are surging during a rate cut cycle

source: @robin_j_brooks on X

Treasury bond yields are spiking in every G8 country, with the UK, Germany, France, and Japan the most impacted, though US yields also spiked. Japan’s bond yields spiked to their highest rate in history, France’s yields are at their highest since the 2011 Euro debt crisis, and the UK’s yields went up at an exceptionally alarming rate. Global bond yields have been on the rise for a while, though they massively surged over the past few days. The recent bond yield spike vindicates my point from my article from August 29th that yields will continue to rise despite rate cut cycles. This is due to rising debt and political and geopolitical instability.

source: @Barchart on X

source: @KobeissiLetter on X

There is an inverse relationship between the price of bonds and yields in which the more bonds bump the more yields go up. This is because treasuries have to pay future borrowers more, as it becomes harder to attract new buyers. The spike in the 30 year yield especially signals real concerns about long term volatility. Stocks also closed negative after a summer bull market, though it wasn’t a crash. For some reason, September is more bearish after bullish summers. Regardless, bond markets are a much better metric of the health of the economy than stocks. Not to mention that gold prices are soaring as a hedge.

source: @lisaabramowicz1 on X

What is especially notable is that the UK is already cutting interest rates. Usually when bond yields spike there is a self correcting process in which the higher yields make bonds a good investment. However, the UK Pound also crashed relative to the Dollar, which is an ominous sign. The yield spike is a signal that the UK’s central bank has lost control over interest rates, as their inflation is resurgent. The US is also seeing an upturn in inflation, albeit much more modest. Basically, higher inflation means that rates will go up in the future, which is bad for bond markets.

source: @great_martis on X

“The US Bond Market has now been in a drawdown for 61 months, by far the longest in history.”

source: @charliebilello on X

The UK is on the verge of a fiscal crises that is comparable to the 1970s Sterling Crisis, or Third World countries that get bailed out by the IMF. Bond markets are factoring in that many nations, especially in Europe and East Asia, are rapidly aging, which means more healthcare costs, thus greater projected spending and debt. This is a reason that Europe is bringing in all these migrants, though that is actually making economic and debt problems much worse. Trump requiring European nations to increase their spending on NATO to 5% of their GDP is forcing them to sell off their bonds to cover the cost. Not to mention that Europe is already spending a lot to fund the Ukraine war.

source: @StatisticUrban on X

Keep reading with a 7-day free trial

Subscribe to Robert Stark's Newsletter to keep reading this post and get 7 days of free access to the full post archives.