Source: @NewsLambert on X

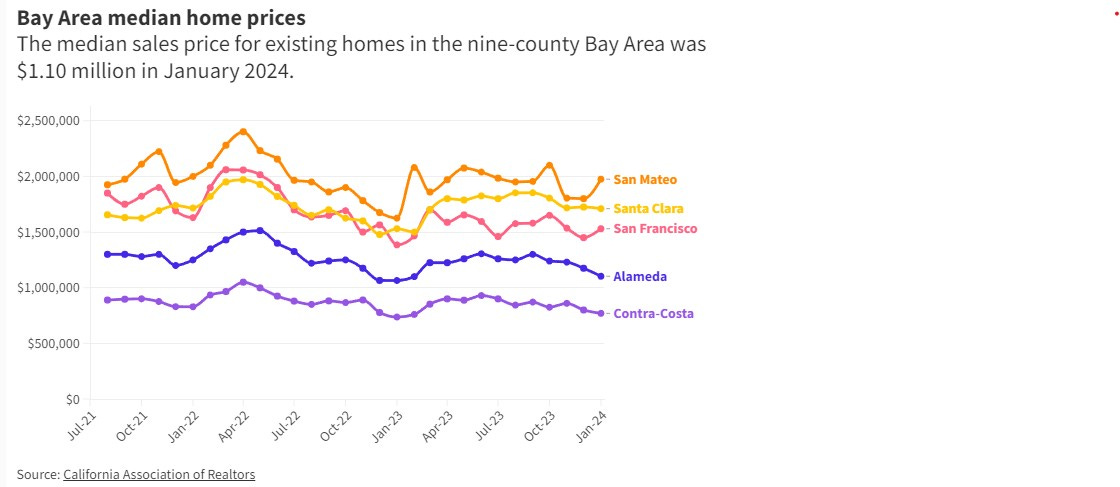

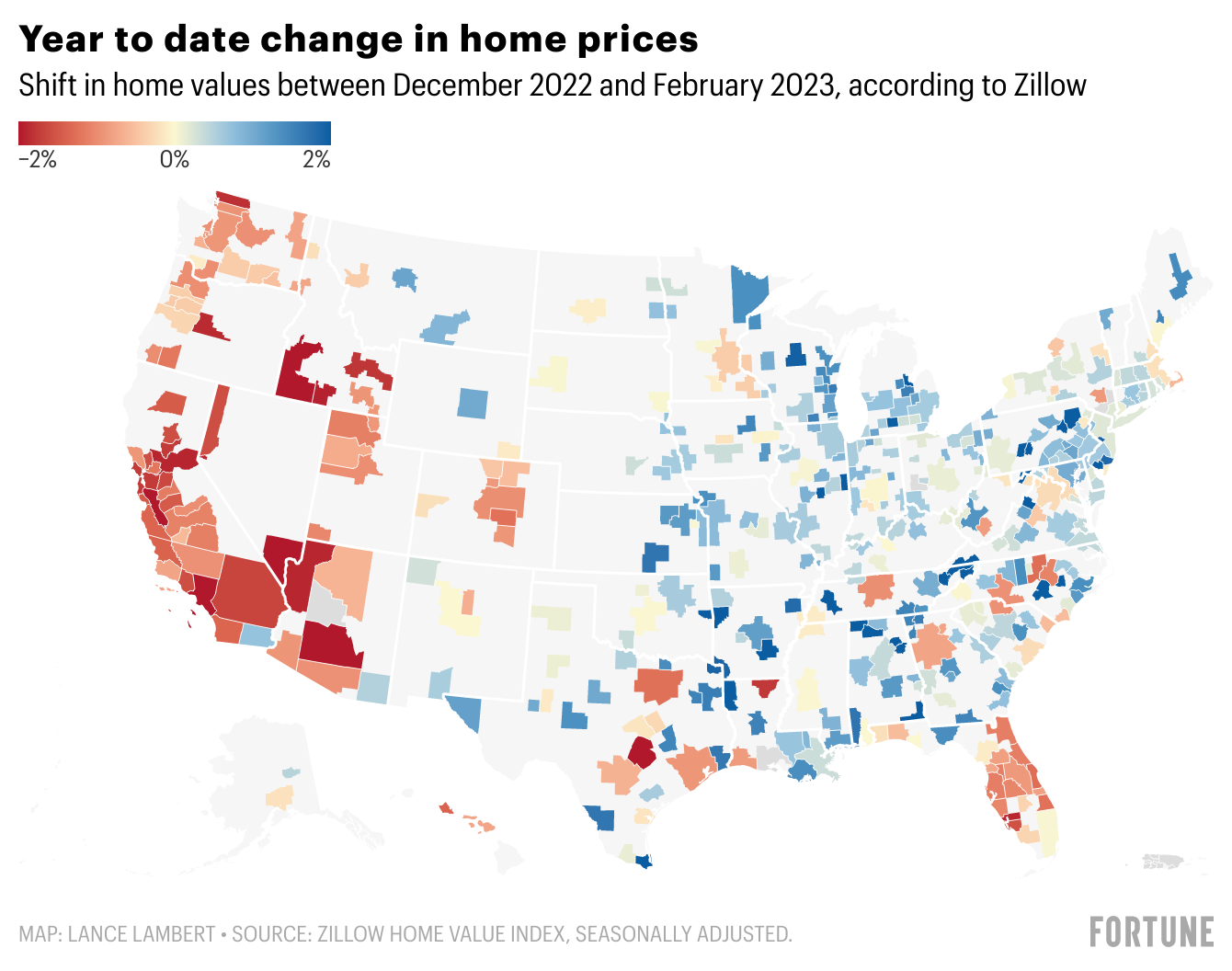

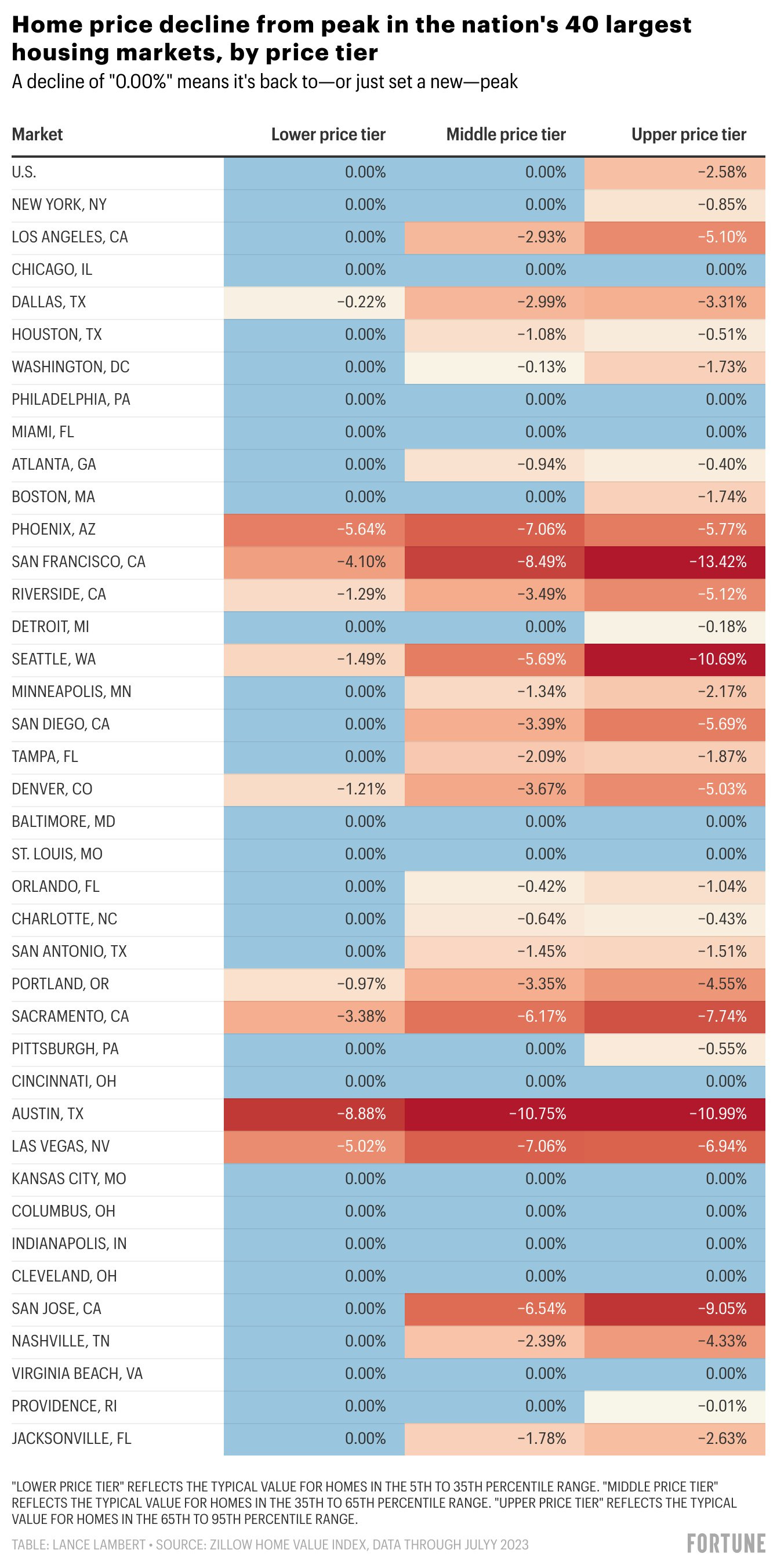

Last year, there was a shift in real estate, with markets stronger in the Eastern US but a slowdown in the West. The West rose disproportionately during the tech boom and was hit harder by going remote and tech crashing, as well as Progressives ruining cities. While the Bay Area escaped the worst of the housing crash in 08’, another tech bubble crash on top of a real estate bubble crash would be catastrophic. Regardless, Bay Area home prices ticked up this year in hopes of a Fed pivot after high-interest rates caused a slowdown last year.

Source: Fortune.com

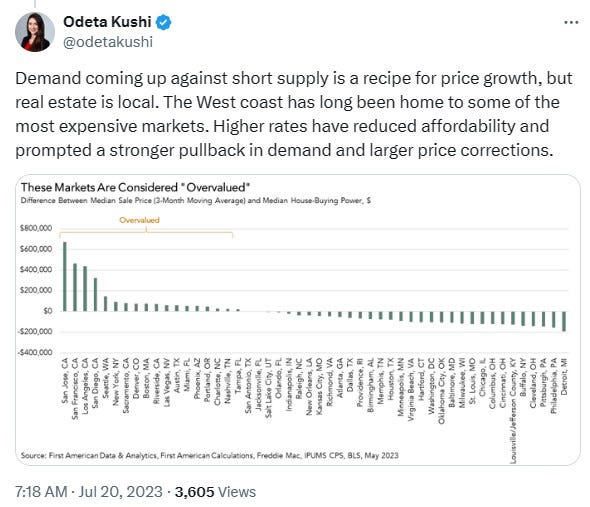

Bay Area real estate forecasts are more bullish again, including for Silicon Valley residential real estate, despite tech layoffs. While forecasts don’t necessarily match up with reality, a lot of demand is due to a lack of inventory. Demand coming up against short supply is a recipe for price growth. However, a lot depends upon interest rates and the tech industry. Not to mention hopes that AI, which is obviously in a bubble, can save the Bay Area’s economy and real estate market.

Source: Siliconvalley.com

California metros have some of the most overvalued housing markets in the Nation (San Diego-Carlsbad – 70.0%, San Francisco-Oakland-Hayward – 69.8%, Los Angeles-Long Beach-Anaheim – 66.1%, Riverside-San Bernardino-Ontario– 66.0%). The metric for overvalued is contrasting home prices with wages. Places like the Bay Area’s jobs to housing ratio are so extreme, which means that real estate is vulnerable to mass layoffs.

Source: Fortune.com

The places where housing prices plummeted the most in California in 2023 were Dublin (-15.75%), Truckee (-13.50%), East Palo Alto (-13.47%), San Francisco (-13.04%), Palo Alto (-12.80%), Pleasanton (-12.14), Alameda (-12.12%), and Oakland (-11.94%). In contrast, the fastest growing home prices were Hidden Hills (+6.7%), Newport Beach ( (+10.6%), La Canada Flintridge (+14.5%), Rancho Santa Fe (+7.6%), Del Mar (+7.6%), and Coronado (+9.9%). SoCal real estate is stronger than the Bay Area, and affluent Coastal San Diego and Orange County are especially strong. These are places where tons of affluent people would like to live and are desirable for geographic attributes, such as being near the Coast. The most vulnerable real estate is places linked to jobs that can go remote or get terminated like Silicon Valley, urban cores impacted by crime and urban decay, as well as places people moved to for cheaper housing like the Inland Empire.

Source: Fortune.com

Nationwide, homebuilder confidence has brightened due to hopes for a Fed pivot, which is now looking less likely. California metros performed poorly for the top metros for residential construction permits. San Francisco ranked just behind LA, at number 40, near the bottom of the entire Nation. The top California metro for new permits was Sacramento (25th), followed by Riverside-San Bernardino (28th), San Jose (30th), and San Diego (37th). However, NIMBYism is a major reason why builder permits are so low for LA and SF metros compared to the rest of the Nation.

Source: Federal Reserve Economic Data

Source: Federal Reserve Economic Data

California recently became more YIMBY on housing, in perfect timing for the incoming real estate crash and recession. Expect to see fewer new skyscrapers and megaprojects under construction, especially office projects. While California going YIMBY may not be enough to offset the recession, I am more bullish on missing middle residential projects, like midrise apartment complexes.

A lot of high-rise projects were canceled after the 2001 dotcom bubble crash and the 08 financial crash. One of the greatest tragedies was the loss of potential Art Deco skyscrapers due to the Great Depression. The 70s stagflation era and early 80s recession were a mixed bag for high-rise construction. On one hand, stagflation and the recession slowed down demand for real estate. However, Japanese investment financed many skyscraper projects, plus there were some aggressive urban renewal projects in response to urban decay. A lot of the tallest high-rises in Downtown LA and SF were built in the 70s or early 80s. Ironically the booming 90s were a low point for high-rise construction, as there was a rise in NIMBYism, plus a shift in tastes to low or mid-rise office parks for Hollywood and Silicon Valley.

Source: Odeta Kushi on X:

Construction trends depend upon whether inflation is allowed to surge to prop up real estate assets or whether there is a deflationary crash in asset bubbles and or a credit crunch. The former would wipe out the working class but could be good for real estate in more affluent areas and urban cores, while the latter would halt most new construction. There is a strong correlation between whether the Fed pivots and new construction.

As far back as two decades ago, James Howard Kunstler was making the point that the financial infrastructure that sustains skyscrapers, megaprojects, and mass sprawl subdivisions was unsustainable. Skyscraper construction reflects speculative bubbles as well as foreign investment, especially Chinese. China’s financial and real estate crisis could have a ripple effect on California real estate, though the Chinese might also still invest as a hedge against their crashing real estate.

Following development sites like UrbanizeLA and LAYIMBY for LA and SFYIMBY and Socketsite for the Bay Area, there are surprisingly still a decent amount of new high-rise proposals, though overwhelmingly residential and not so much commercial. The question is whether these new proposals are a sign of the bubble or from organic demand. There is a case that housing scarcity is preventing the housing bubble from crashing, despite the Fed propping up real estate. Not to mention that the migrant crisis is likely being used to prop up real estate, at the expense of rental inflation.

Builders Remedy is a clause that when cities fail to meet housing mandates they are forced by Sacramento to suspend zoning and give developers free rein. While Builders Remedy and granting all zoning powers to the State Government has potential downsides, it will show how much unmet demand there is that has been held back due to NIMBYism. Especially on the Westside of LA and Silicon Valley, and the Peninsula in the Bay Area, all of which have a lot of low-slung housing inventory. Beverly Hills and Palo Alto are already getting some ambitious high-rise Builders Remedy proposals. However, Builders Remedy could be more of a bargaining chip to pressure cities to make more concessions on housing.

Source: @jburnmurdoch on X

Downtown SF has had a major slowdown in new high-rise proposals, and a lot of proposed high-rise projects in SF are getting abandoned. However, there are still ambitious high-rise proposals in other parts of SF and throughout the Bay Area. For instance, a proposed 50-story skyscraper by the Coast in the Sunset District, plus Berkeley and Santa Clara are undergoing booms in high-rise proposals after being NIMBY for so long.

Source: Commercialobserver.com

The situation is similar for LA, where Downtown LA is also seeing a slowdown with high-rise projects canceled or under-construction projects put on hold and covered with graffiti. However, a 2 billion dollar megaproject was just proposed on the periphery of Skid Row. This disconnect between projects getting canceled but also ambitious new proposals is a sign of the bubble and volatility. Not to mention that LA’s new “Mansion Tax” is stifling new development, as landowners are less likely to sell. Regardless, residential demand seems strong in Miracle Mile and the Westside.

Source: New York Post via Forever California

Of proposed Bay Area Megaprojects, the Concord Naval Weapons Station Redevelopment faced some major setbacks but still has a better chance of getting built than other megaprojects. Google’s proposed development of a mega campus and new urban district near Downtown San Jose has stalled, as has Oakland’s Brooklyn Basis redevelopment. The most ambitious megaproject in California is Forever California in Solano County, which is financed by Silicon Valley billionaires. The project is planned to be a medium-sized city, accommodating up to 400k residents.

I am somewhat skeptical of Forever California getting built, as it is likely financed by debt, thus sensitive to interest rates and bubbles crashing. The developers also have to secure ownership of the land, and a lot of landowners are refusing to sell. Not to mention the lack of adequate water rights and transportation connecting it to the Bay Area and Sacramento. Forever California reminds me of the failed, Quay Valley, a proposed new city on the I-5 in the middle of nowhere, halfway between LA and the Bay Area, which disbanded after the 08 recession. Both projects were shilled as eco-friendly and technologically advanced. However, Forever California’s developers are likely hedging on the long term past the recession, with construction probably not starting until at least 2030.

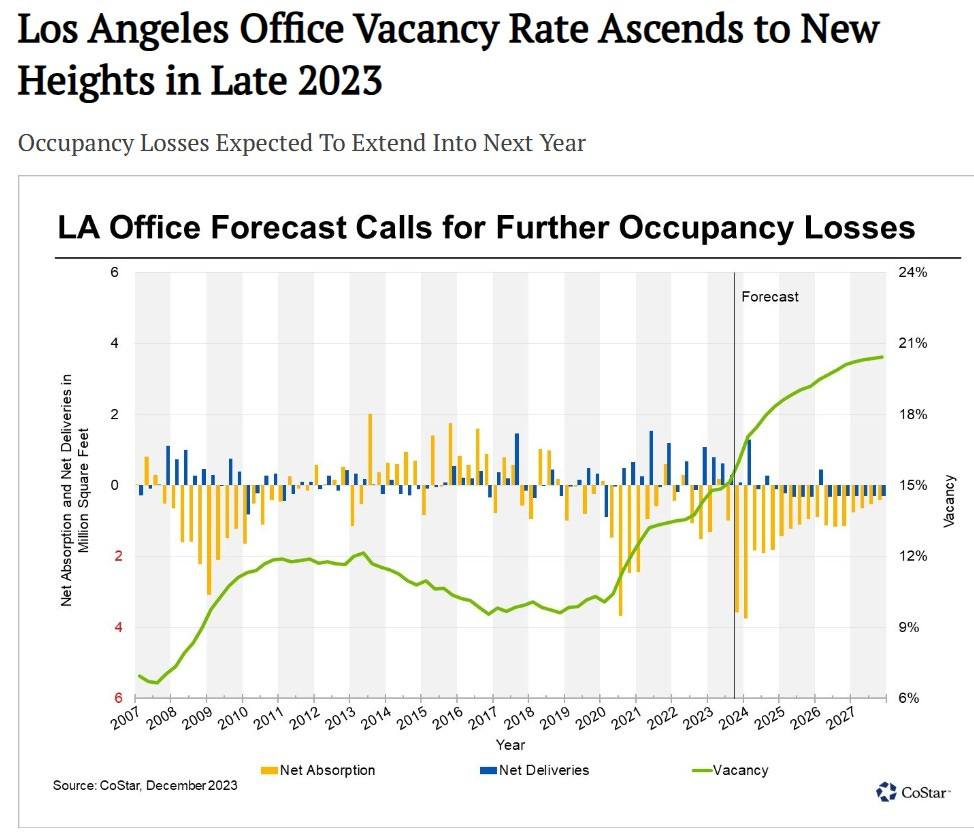

Commercial real estate is extremely vulnerable to crashing, with San Francisco office vacancies reaching a record high of 35.9% and 26.6% for Downtown LA, with vacancies only projected to get worse. In contrast, the national vacancy rate is 19.3%. Besides organic demand and supply constraints holding off a crash in residential real estate, high interest rates mean that homeowners are holding off on selling. Unlike the 08 financial crash where homeowners got foreclosed on, the cost of low-fixed mortgages from before rate hikes might end up harming the banks rather than the homeowners. Homeowners refusing to sell, causing a lack of housing inventory, is bullish for rental markets and inflationary for renters. For this reason, I don’t foresee a huge crash in residential even though apartment and condo complexes are linked to commercial real estate and the financial system, and some landlords are still in the red from the pandemic eviction moratoriums.

Source: @unusual_whales on X

While the recession could dramatically slow down new development, foreclosures in commercial real estate could mean more properties on the market to be redeveloped, as landlords and banks are forced to sell. Office towers might get converted into residential and foreclosed strip malls redeveloped into residential or mixed-use. However, the high Fed rates that will cause commercial landlords to refinance at higher rates, will also hinder new construction. While there is a lot of demand for turning commercial to residential, the process of retrofitting office space is fairly expensive and won’t be enough to save commercial landlords and banks from defaulting. The benefits of office conversions easing housing supply and revitalizing urban cores are long-term.

Downtown SF is on the verge of collapse and Downtown LA isn’t doing much better, it’s just that LA is more decentralized. The deterioration of urban cores with decay, crime, and homelessness will likely get worse in the near term. However, there are some urban areas where homeless encampments have been cleaned up that continue to gentrify while other areas are becoming designated containment zones for homelessness. While SF got away with bad policies because of immense tax revenue from the tech industry, the loss in tax revenue could force radical change, but things may have to get worse before they can get better. If tech crashes, SF will be forced to focus more on tourism, which will require cleaning up urban blight. However, SF’s tourism industry isn’t doing great either. Regardless, the recent SF election shows some pivot to the center on homelessness and crime.

New York’s Lower Manhattan successfully transformed offices into residential in response to 9/11 and the 08 financial crash. There was a proposal to convert office space in SF’s Financial District to student housing for UC Berkeley students. Also, a revival program for Downtown SF envisions pop-up bars, restaurants, and art galleries. Financial Districts could become arts and entertainment districts and much more lively. Art scenes emerged from deindustrialization, so will high-rises have nightclubs, live works spaces, and art galleries, that host the next generation’s equivalent of the Hipster scene?

A somewhat probable conspiracy theory is that oligarchs are destroying urban cores with leftwing policies so that they can buy up property cheaply and redevelop urban cores. The ultra-wealthy are also likely to exploit the recession to export a lot of the riffraff out of State. Even though I am overall bearish about the economy, I am less bearish than many on California real estate. Zoom towns in flyover country, where people relocated to with remote work, are much more at risk than California when the mass layoffs hit.

Good analysis.

I would add:

Ca has a lot of missing never built units. Basically big developers have downsized or left the state because it takes so long to build compared to Texas or Florida, and has a lot more risk. Bruce Norris has mentioned this in his presentations. He moved his portfolio from Ca to Fl due to his inability to forecast Ca’s government’s actions, and its impact on the real estate market.

Ca now has rent control, and it may get worse. This will be impacting multifamily construction,

Ca laws for landlords are getting worse, and some cities are nightmares for landlords (sf, la, Oakland come to mind).

For multi family the only thing that is being built is higher end units. Class A. Due to environmental, zoning, building codes, without subsidies the lower end stuff does not pencil out. So there is a shortage of class c and d apartments.

Homeless are everywhere, unfortunately. As is the urban shoplifting. I see this in Riverside, oc, and of course La county.

Can’t say I shed many tears for wealthy homeowners or commercial real estate conglomerates. They are more of a problem economically and socially in California than so-called ‘riff-raff.’