The recent Bullishness and why a Hard Landing is still inevitable

Market sentiment has gotten much more bullish since when I wrote No Collapse is the Real Dystopia in June. This summer saw a major bull market, or rather bear market rally, with the Dow reaching its longest winning streak since the 1980s. The “top economists” did a total U-turn and no longer expect a recession this or next year. The recent bullish sentiment feels similar to 2021, when covid was easing and there was a surge in stimulus. This wave of bullishness continues, despite stocks dipping after Fitch downgraded the US credit rating.

The current bullish propaganda is identical to that before the 2008 crash. For instance, Tyler Cowen’s recent Bloomberg op-ed, The US Economy Is Great. Stop Worrying About It, is much like Brian Wesbury’s 2008 WSJ op-ed, “The Economy is Fine (Really) . A recent CNN Business article, the case for a soft landing, is much like a CNN Money article, making the strong case for market optimism in 2008. In January of 2008, Fed chair, Bernanke, proclaimed that the Fed is not forecasting a recession. The main arguments that bulls make for their soft landing thesis are that unemployment is still low, inflation has gone down, GDP growth, and high stock prices, despite countless signs of economic peril.

While foolish economic optimism is expected from clowns like CNBC’s, Jim Cramer, who was notorious for saying don't be silly on Bear Stearns before the crash of 08, even respected financial figures who are more bearish, like Mohamed El-Erian, were recently shilling an impressive economic recovery. An example of blatant propaganda from bulls, is a Bloomberg interview with Blackrock’s Rick Rieder, in which Rieder dismissed that the Yield Curve has been wrong at flagging many recessions, agreeing with "Economist" Ed Yardini, who said that “the yield curve is different this time because we have a "Nirvana Scenario." This is blatantly false, as the Yield Curve has accurately predicted every single recession, and was only slightly off once in the 60s. It is notable that Yardini was saying the same about the Yield Curve back in April of 2008. The Yield Curve has inverted the most since the early 80s recession.

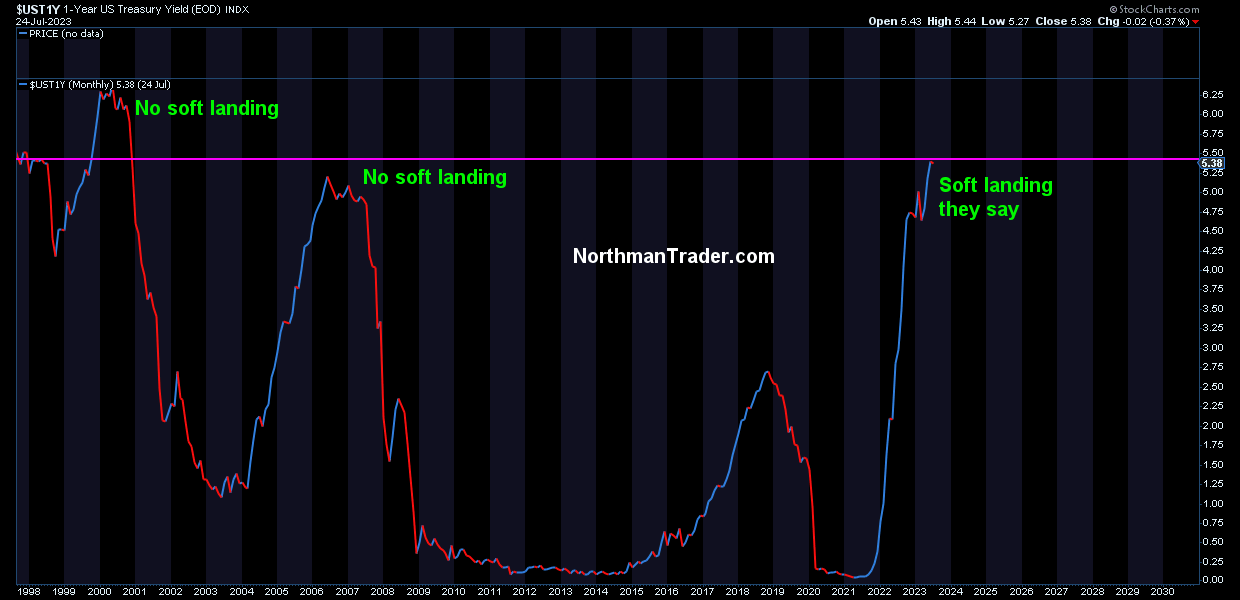

1 Year Treasury Yield

Source: Northman Trader via @StockCharts.com

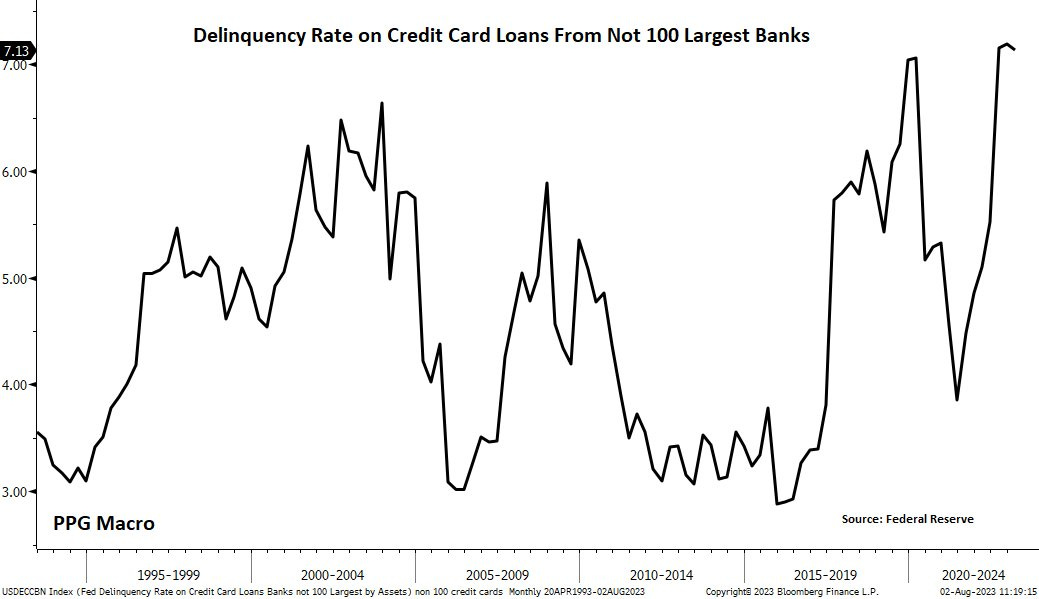

Blackrock’s Rieder also dismissed that rising interest rates will have a major negative impact on the economy, only focusing on those with fixed mortgage rates while ignoring that medium house payment are up 19% from 2022, the most expensive ever, and 30 year mortgages are at the highest rates since 2000. Rising interest rates, which are at the highest level in 22 years, coincide unprecedented levels of debt, with credit card balances at 20 year highs and US adults having more credit card debt than total savings. Also delinquency rates on credit card loans from small lenders are at a high of 7.1%, above the last peak of 6.0% in 2008, a rapid rise from 3.8% in 2020. When interest rates were near 0, corporations took on loads of debt, that they will face a reckoning on when they are forced to refinance at higher rates. Total US debt, including government, business, and personal debt has reached a whopping $100 trillion.

Source: Kobeissi Letter via Federal Reserve

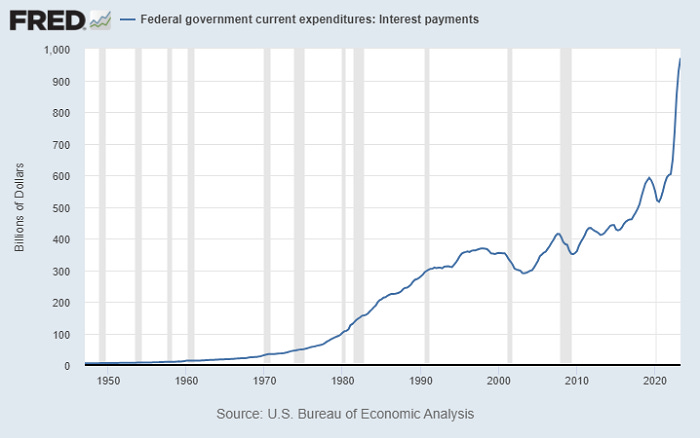

Interest expense on the national debt reached 1 trillion for the first time, surging 50% in just the past year, and interest expenses will soon account for over 20% of all government expenditures, which is higher than national defense spending. This will only accelerate as rates rise or at least have to be sustained, and over the next 10 years, the Congressional Budget Office projects interest costs to hit $10.6 trillion.

Source: Kobeissi Letter via US. Bureau of Economic Analysis

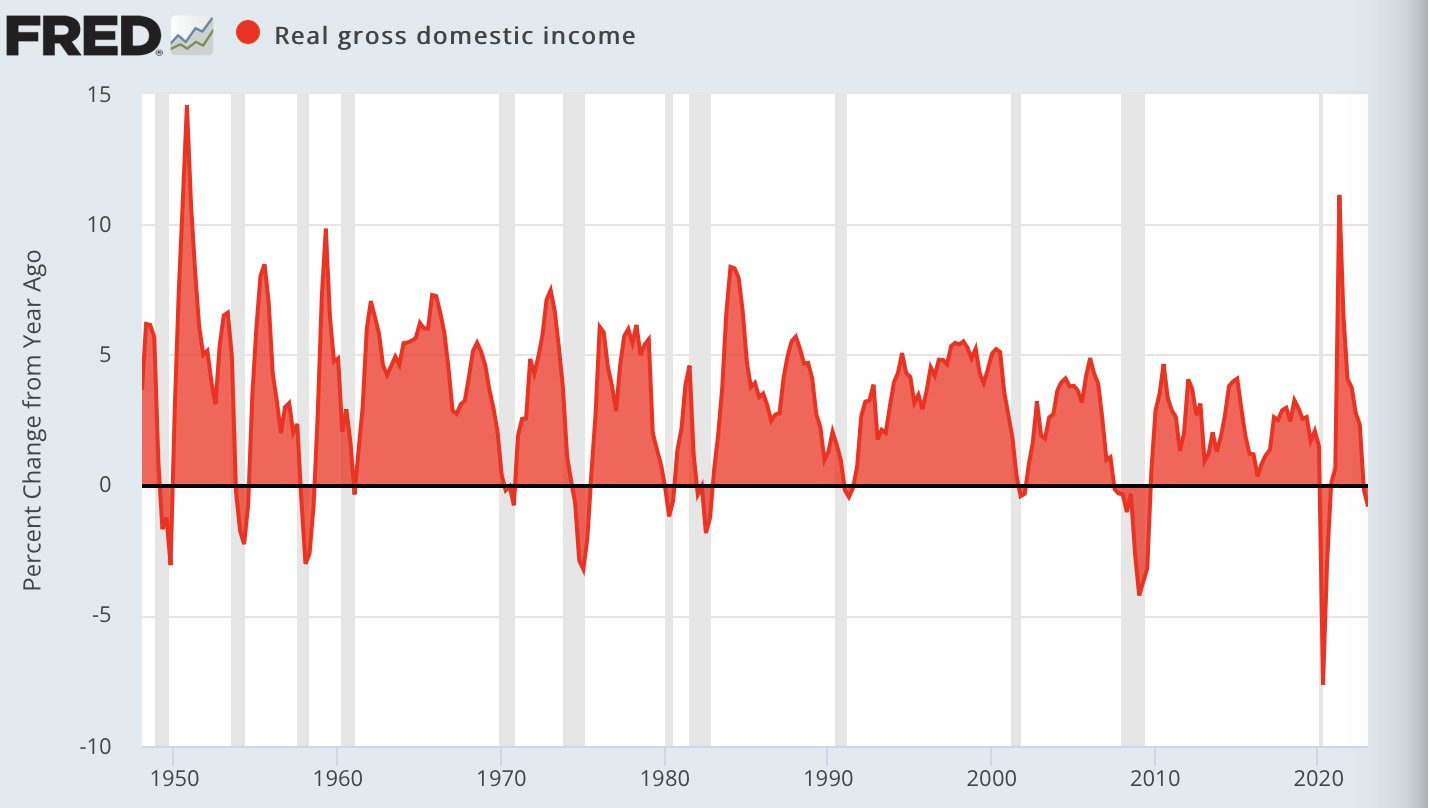

In contrast with strong GDP growth, GDI (Gross Domestic Income) has turned negative and declined over the last two quarters. The Fed’s Real Gross Domestic Income chart shows a major dip from covid, and then massive growth due to stimulus, before dipping negative again. The massive divergence between GDP and GDI is explained by massive government spending, as GDI is derived from income rather than expenditure data. Another factor for this divergence is the recent surge in migration, with even the New York Times, basically admitting that Bidenomics hinges upon mass migration. This is because migration grows the GDP while reducing labor inflation by undercutting wages.

Source: Northman Trader via Federal Reserve Economic Data

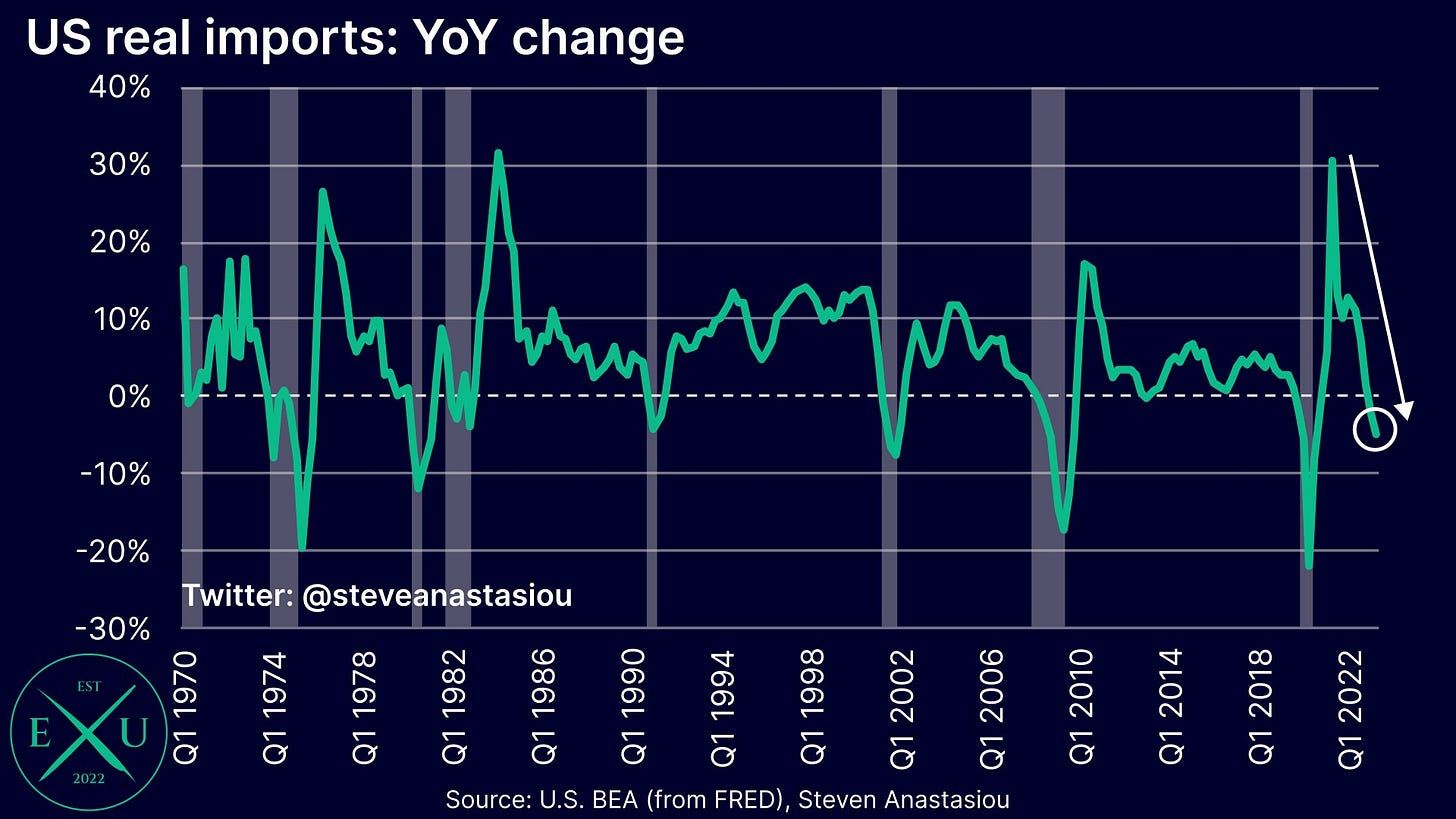

Another bearish metric is the US Leading Economic Indicators, which were minus .7% for June, and negative for the 15th consecutive month. This is the longest negative streak since 2007/08 before the Global Financial Crisis. Other bearish indicators include the Philly Fed’s Manufacturing Survey, signaling 10 straight months of contraction, and Chapter 11 "reorganization" bankruptcies surging 68% for the first half of 2023, with filings for small businesses climbing by 55%, and 340 U.S. firms filing for bankruptcy in the first half of 2023, a new 13-year high. The US trucking firm, Yellow, just declared bankruptcy, which had about 30k employees. Also US imports have plunged to an annualized rate of -7.8 for Q2 of this year, which is the worst decline since 1970.

Source: @steveanastasiou via Federal Reserve Economic Data

The US added 187k jobs in July, which is below expectations of 200k, while the unemployment rate fell from 3.6% to 3.5%. According to recent US Manufacturing Survey data employment is the weakest since the covid lockdowns, and Vanguard’s top economist proclaimed that Americans are about to start losing their jobs — and that will spoil the Fed's dream no-recession scenario. Not to mention that the Government just admitted that millions of unemployed people were not counted. While there has been a slowdown in layoffs, there is also a slowdown in new hiring, which signals either stagnation (stagflation) or a transition period from boom to bust.

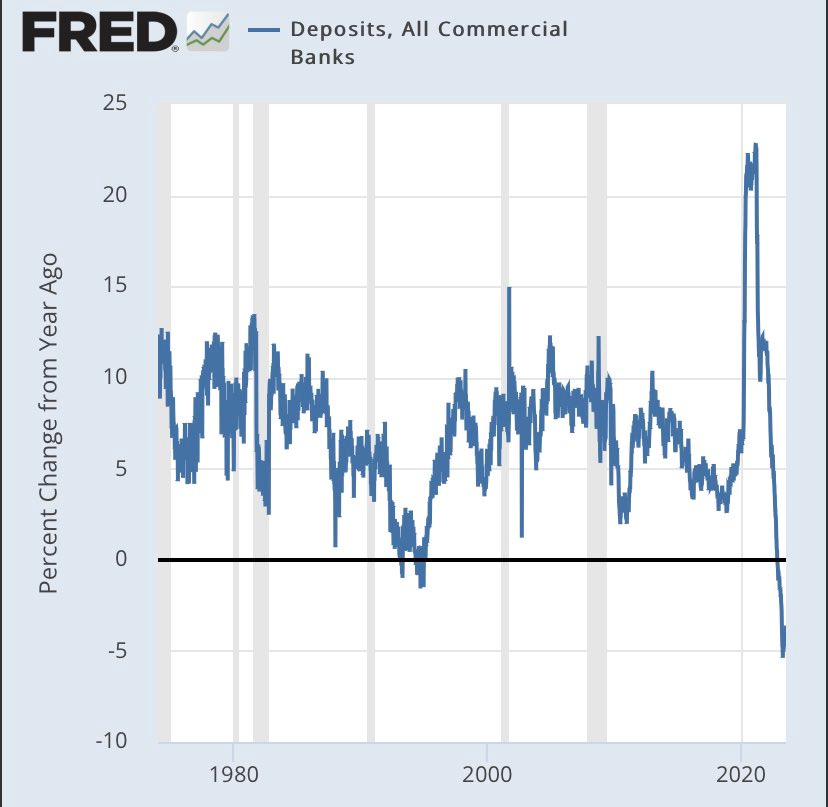

This spring’s banking crisis is far from being resolved, with the Heartland Tri-State Bank in Kansas becoming the fifth US bank to fail this year, and now Moody’s is cutting the ratings of 10 major banks, including some big names. Banks are hyper-sensitive to higher interest rates, which means that higher debt repayments are stifling loan creation. Bank deposit growth continues to plunge negative at an unprecedented rate, and it has been exposed that banks were intentionally under-stating their uninsured deposits. No to mention that a likely commercial real estate crash will take down many more regional banks.

source via US. Bureau of Economic Analysis

The bond market is on the verge of a major breakdown with the yield on the 10-year Treasury reaching over 4.1% for the first time since November of 2022. Also Hedge Funds are shorting treasury bonds at historic levels. However, Friday the bond market recouped some of the loses from last week’s carnage, largely due to the less than stellar employment data, signaling hope for a Fed pivot on rate hikes. Regardless, the cost of financing the $32.7 trillion National Debt is going to crash the bond markets. There is also danger that Japan, as the number one holder of US treasury bonds, will dump US bonds to pay down their debts and save the Yen, just as the Fed is selling off treasuries. This alone could crash the US economy and trigger a global financial crash. Just contrasting the disconnect between stocks and the bond market shows that this gap will close violently for the markets.

Source: Game of Trades

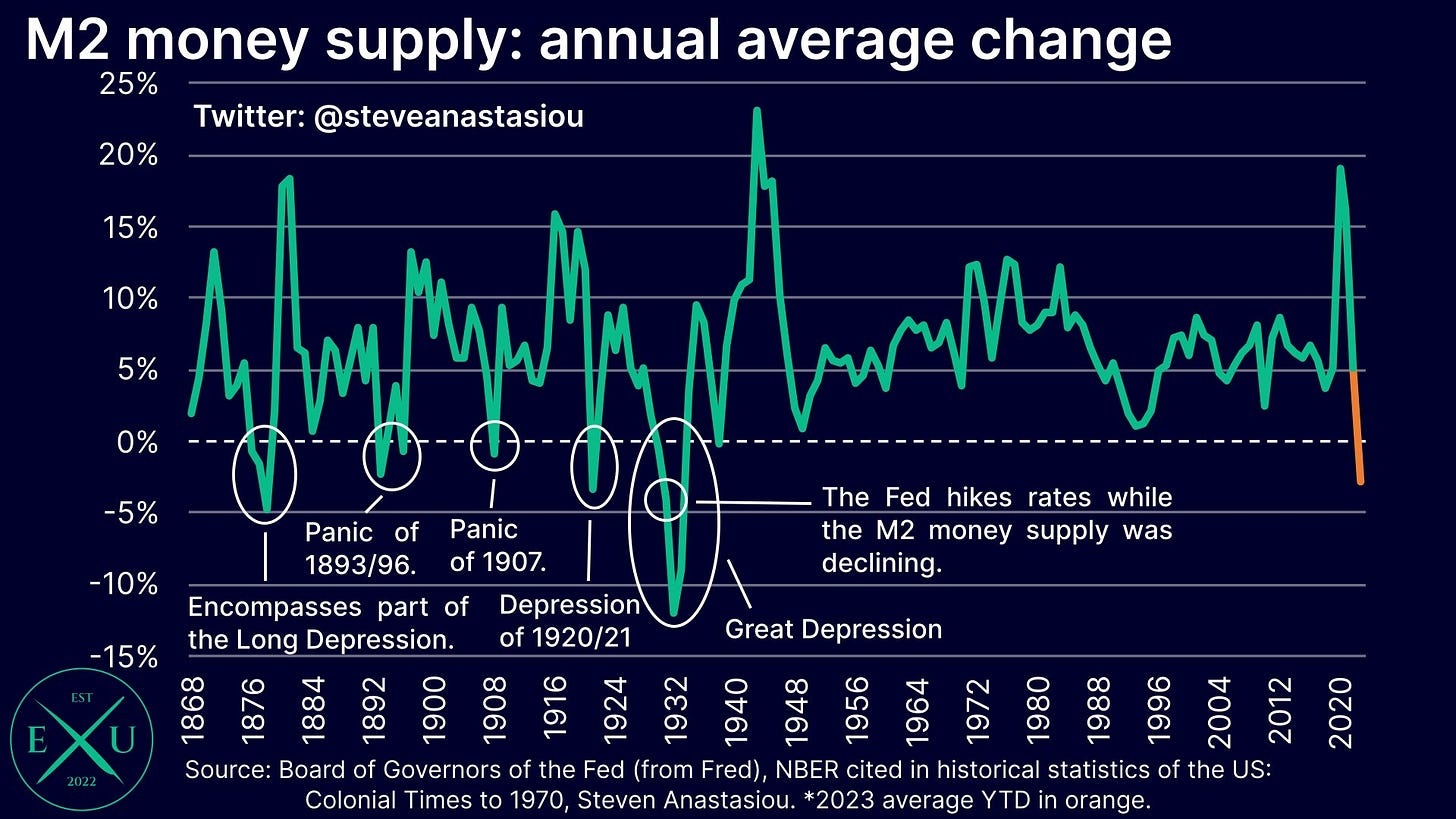

While the Fed reduced its balance sheet by 8% since its peak, the money supply is still twice the size that it was pre-covid, taking into account that about 40% of all money in circulation was printed in just 1.5 years. The US is still spending 44% of GDP per year, which is similar to World War 2 levels. The M2 Money Supply’s growth rate has gone negative this year, contracting at the fastest rate since the Great Depression, though the Money Supply expanded again recently after contracting. The M2 Money Supply has increased while the Fed’s balance sheet decreased, which can be explained by the Fed shrinking its assets and selling off bonds (quantitative tightening), while also targeted bailouts of banks, and purchasing bonds from corporations such as Apple and Disney, which props up the stock market. Not to mention the overall high levels of spending. This combination of expanding the money supply and then contracting sharply is extremely volatile.

Source: @steveanastasiou via the Board of Governors of the Fed

While inflation declined significantly from last year’s peak, there are worrying signs that inflation may resurge again, much like during the 70s. Much of the reduction in inflation was due to supply chain issues getting resolved, as well as the strengthening of the dollar. The ten year note yield was trading like inflation is back on the rise, and surging oil prices and collapsing bond prices, as well as the dollar and bond yields going down while stocks are up are major inflationary signals.

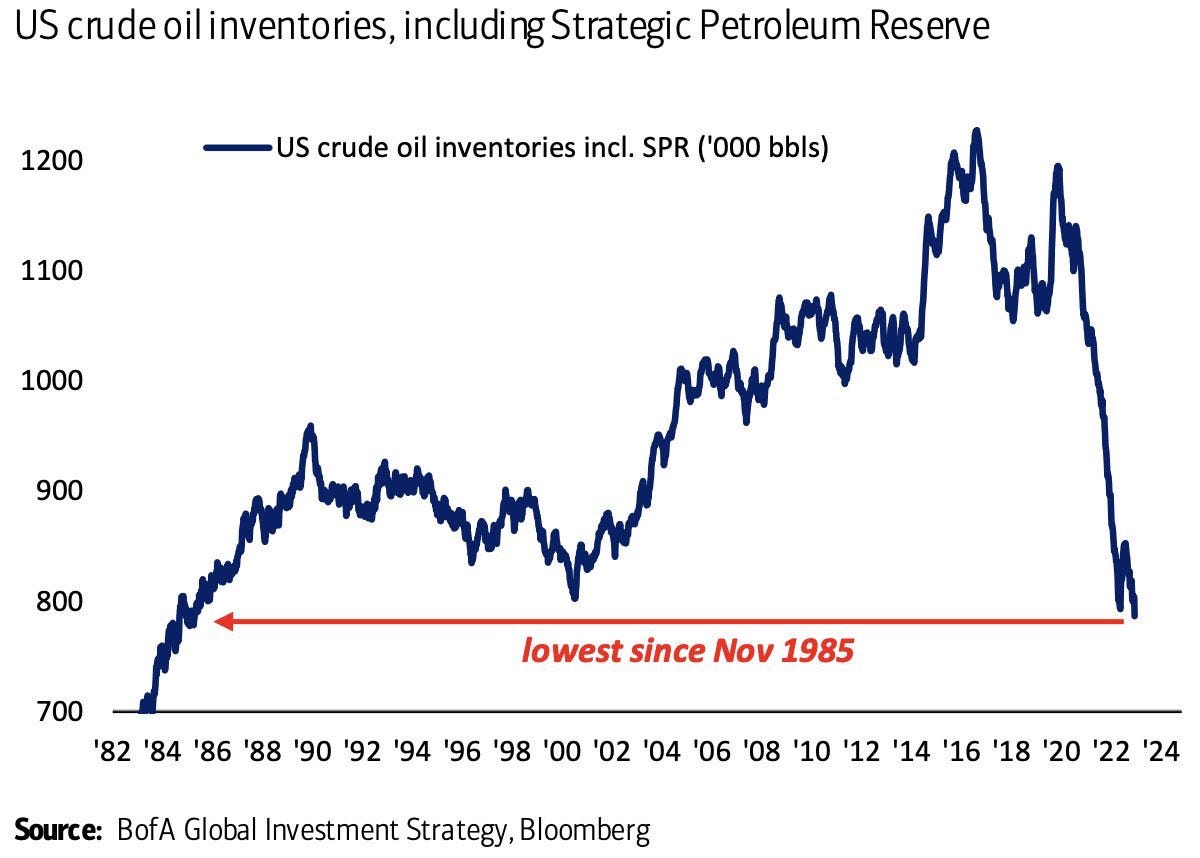

Source: Kobeissi Letter via BofA Global Investment Strategy, Bloomberg

Besides core or monetary inflation, commodity prices are set to spike. The price of oil is up to $82 a barrel, the highest since April, an increase of 30% over the past three months. This is because of OPEC production cuts while Biden has failed to refill the Strategic Petroleum Reserve, after depleting reserves to keep prices down last year. Now US oil reserves are at the lowest levels since 1985. Also Ukrainian drones are starting to strike Russian oil tankers in the Black Sea which will further limit supply. Agricultural commodities are up and just 3% away from reaching the highs from the beginning of the Ukraine War, due to the end of the grain deal between Russia and Ukraine, as well as India restricting rice exports. Overall commodities were up significantly for July.

Commodities Price Index

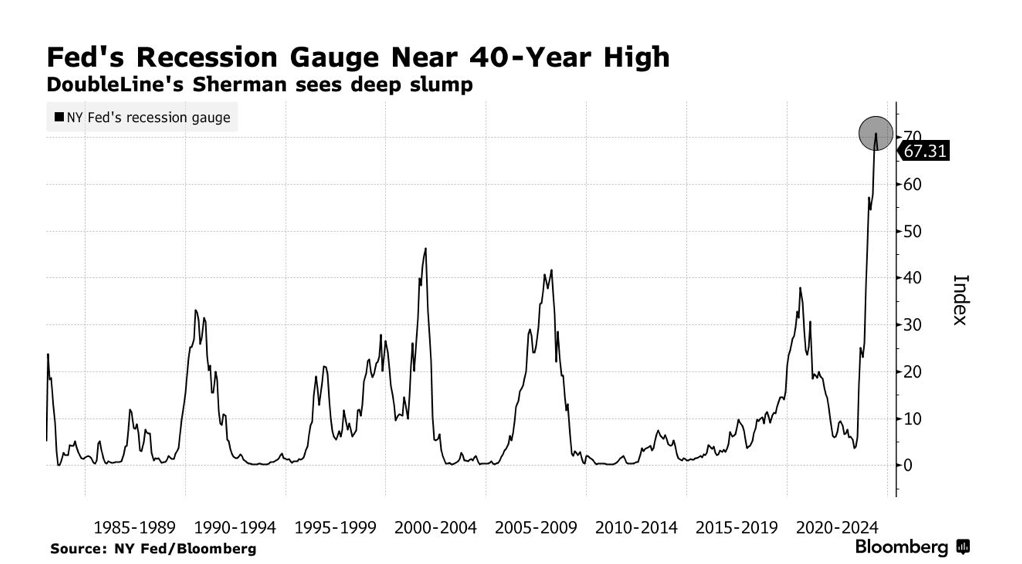

At the onset of the pandemic, the Fed dismissed concerns about inflation. Then in January of 2021, the Fed claimed that inflation would just be “transitory,” and by September of 21’, the Fed totally dismissed the need to raise interest rates to quell rising inflation. However, the Fed changed course by January of 22’, when Powell called for hiking rates to cause a recession, as the only way to end inflation. By December of 22’, the Fed proclaimed that inflation had been defeated, and by February of 23’, that a “soft landing” was possible. Then the Fed downplayed the severity of the banking crisis in March, claiming that the financial system was stable. Now the Fed is no longer expecting a recession, despite being proven wrong every single time. This is a total contradiction of Powell recently stating that “the full effects of tightening are yet to be felt,” and the Fed’s recession gauge predicting a much worse recession than it did before 08.

Source: Northman Trader via NY Fed/Bloomberg

Bloomberg News admitted that an economic soft landing hinges upon the Fed’s tolerance of inflation, and the Fed pursuing this fantasy of defeating inflation without causing a recession will cause the 2nd wave of inflation followed by a severe recession. Powell still insists upon a 2% target, which is unrealistic without a deflationary crash. Stocks rallied over hints that the Fed will pause this year and cut rates next year, but ironically the stock rally gave the Fed a cushion to raise rates in July. The fact that a recession has not materialized means that the Fed will have to keep rates high longer. So good economic news is bad news and there is no escaping the trap, that rate hikes will cause a crash while a pivot will cause inflation to resurge. The soft landing thesis hinges upon a hope of maintaining this goldilocks zone where inflation declines without any rise in unemployment, and then the Fed cuts rates, which is utterly delusional.

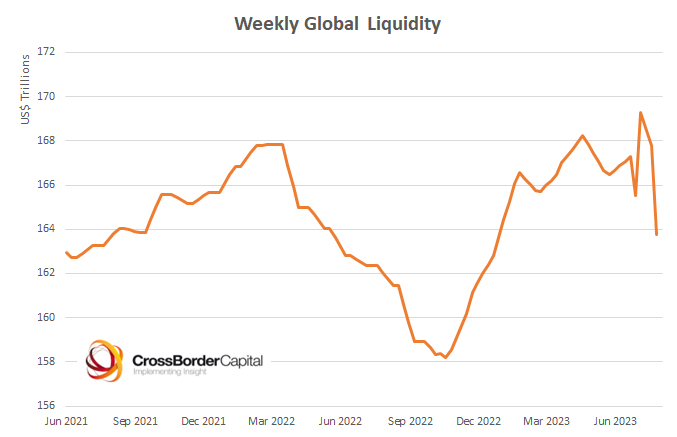

The Fed’s plan seems to be to gradually continue tightening or keep rates the same, and then use that cushion to cut rates or simulate if a major crash occurs. This is all at the expense of letting small businesses and regional banks crash from a lack of liquidity, with higher rates leading to greater economic consolidation. Basically a controlled demolition of the economy and wealth transfer from the middle class to the 1% and large institutions. Debt is what is going to take down the economy, and there is a high likelihood that the Fed will just inflate the debt away by devaluing the currency.

source: Cross Border Capital