Speculating the demographic impact of the Recession on California: Part I

Who is the most likely to leave California

Source: Public Policy Institute of California

While the incoming recession could have different implications for demographic trends than the pandemic, during covid, California experienced its slowest growth in recorded history. California actually lost population (a decline of 600k people between 2020 and 22’), from a peak in January of 2020. This decline was due to the exodus, but also covid deaths and declining fertility. Throughout much of the 2010s, California actually gained affluent residents from other states while lower income Californians disproportionately left. However, since the pandemic, enabled by remote work, there has been an exodus among the wealthy, an acceleration of a trend that actually begin around 2018. The Public Policy Institute of California reported that “Most striking, California is now losing higher-income households as well as middle-and-lower-income households.” LA Times’ George Skelton, who had previously been downplaying the exodus, recently admitted that he was wrong, stating that “This is what I wrote two years ago: “More affluent people have been moving here than departing. They can afford our escalating costs of living. Political spin about wealthy people abandoning California is fake news.” On a similar note, Governor Newsom blamed the exodus on Trump’s immigration policies, which is absurd.

Source: Public Policy Institute of California

Source: New York Times

Looking at stats for California’s metros, Los Angeles, San Francisco, and San Jose metros all lost a significant amount of college educated residents. However, San Diego, Sacramento, and Riverside metros, gained college educated residents, likely from the exodus out of LA and the Bay Area. While LA’s college educated exodus began sooner, the Bay Area was gaining large numbers of college educated residents throughout the 2010s, so the shift was obviously due to the tech exodus. Much of the 2010s in-migration of the wealthy was due to the tech bubble creating a lot of high paying jobs in Silicon Valley.

Source: Bay Area Council Economic Institute

During the 2010s tech boom, immigration surged, and even domestic in-migration modestly increased to the Bay Area. Then during the pandemic, there was a massive drop in both domestic and foreign in-migration, though there was a modest rebound in foreign migration in 2022. Even San Francisco experienced a modest rebound in immigration and a slowdown in domestic outmigration, which helped curb population loss in 2022. However, still an astonishing quarter million people left the Bay Area and 60 thousand people, a 7% decline, left San Francisco between 2020-22. Overall I am skeptical of San Francisco’s population rebound being sustained with a severe recession, on top of rising homelessness, crime, and urban decay.

Source: New Geography

A detailed map of California’s exodus by census track from new 2022 data, shows that even many areas that grew during the 2010s, lost population. Practically all of the Bay Area saw some decline, including many desirable suburbs, albeit very modest. The Bay Area’s only growth hotspots are pro-development Emeryville and far out exurbs like Brentwood. Practically all of the LA metro also had population decline with most of California’s growth areas being inland, such as the Inland Empire, Central Valley, and Sacramento metro. However, even inland areas are growing at a much slower pace than during the 00s and 2010s. While the map does not specify racial demographics, overall both wealthy and poor, and White and non-White areas alike, experienced population decline.

Source: Public Policy Institute of California

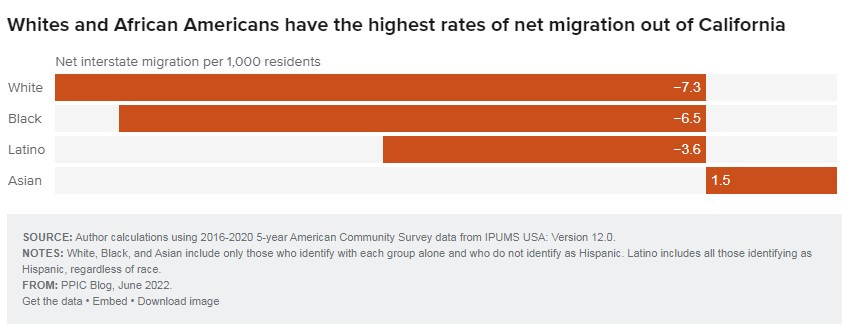

Looking at stats from the Public Policy Institute of California, calculated from American Community Survey data, ranking racial groups by most to least impacted by the exodus, Whites were most likely to leave, followed by Blacks, and then Hispanics, with only Asians gaining in-migration. Ranked by both race and class, the worst decline was for low income Whites (-10.9 per 1,000), then middle income Whites (-9.1), low income Blacks (-7.7), middle income Blacks (-6,17), low income Latinos (-4.2), middle income Latinos tied with high income Whites (-2.9), low income Asians tied with high income Latinos (-1.6), middle income Asians tied with high income Blacks (-0.2), with only high income Asians (+4.8) gaining from in-migration. It is noted that the data is for domestic migration, not including immigration, which has been the main driver for Asian and Latino growth in California.

Source: Public Policy Institute of California

This data is for 2016-2020, so it does not take into account the remote work exodus of the wealthy. There is no data out yet that contrasts the impact of the post-pandemic tech exodus on both high income Whites and Asians, as high income Asians disproportionally work in tech. While income inequality is a huge problem, these stats on the exodus show that racial disparities are actually more of a factor than class, with the exodus disproportionately impacting both Whites and Blacks. However, I suspect high income Blacks having a very low rate of outmigration could be a signifier of the DEI push at corporations, though the decline for affluent Whites was also fairly modest. Overall this data backs up the case that California’s Neoliberalism favors the wealthy over the poor and middle class, but also people of color over Whites, and is especially inhospitable to downscale Whites.

Source: Public Policy Institute of California

Besides the remote worker exodus, tech layoffs are the worst since the 2001 dot com bubble crash, and will probably end up being much worse, as higher interest rates will have to be sustained. Tech job growth has been responsible for much of the Bay Area’s rapid Asian demographic growth, with the Bay Area’s tech workforce being majority Asian (57%), and a major tech crash could slow down Asian population growth. Tech layoffs have had a huge impact on h1b visa holders, mostly from India. However, I have heard conflicting reports, both that h1b visa holders are more, but also less likely to be laid off than native born workers. Some h1b workers may have to return to India, due to their visas being linked to employment, and a lot of them could also get scooped up by Canada. Due to the tech exodus and layoffs, the Bay Area’s Asian growth will likely be slower this decade, than during the 2000’s and 2010’s, though I do not expect to see decline or total stagnation either. This is because the Bay Area also has a strong cultural and community based draw for Asian immigrants and Asian Americans. Not to mention that Asians are heavily represented in other industries, such as healthcare and Biotech. While future waves of Asian immigration to America, will likely be more South Asian and less East Asian, for the Bay Area, East Asians have a stronger community based link while Indians are much more linked to employment in tech. I could see many Bay Area Indian tech workers relocating to Dallas, where there is a huge and fast growing Indian community. There has also been a surge in Indian and Chinese migrants at the border, which could boost overall Asian numbers, though these recent migrants are probably, on average, poorer than tech immigrants.

It is hard to say whether White tech workers are more likely to get laid off, as there has been “equity” based layoffs, targeting Whiter workers, but also reports that DEI hires are disproportional getting laid off. Also a lot of non-tech positions, both diversity consultant types and upper middle class White women in HR, might be disproportionately laid off, hence that meme showing Elon Musk’s Twitter before and after layoffs. Regardless, Silicon Valley corporate leadership is still much Whiter than the rank and file workforce.

Both remote work and the mass tech layoffs are a mixed bag for Whites demographically. Remote work was already increasing White Flight, as a lot of White techies relocated to places that are more culturally and demographically White, such as Boise, Portland, Denver, and Austin, with mass layoffs likely exacerbating this trend. White newcomers who came for tech jobs will likely leave in droves, with dramatic White flight out of San Francisco and Silicon Valley. However, old money neighborhoods and suburbs that are Whiter and less tech centric will see a big decline in techies moving in, thus will stay Whiter. In contrast, a rebound in tech combined with the hybrid remote work model would have exacerbated the trend of tech immigrants transforming Whiter Bay Area suburbs. The core of Silicon Valley will probably become much more Asian, so the tech crash will exacerbate existing ethnic balkanization.

Map of Bay Area Segregation

Source: Berkeley’s Othering & Belonging Institute

Mass tech layoffs are also coinciding interest rates hikes, which are disastrous for new home buyers with mortgages. Easy credit has been partially responsible for California’s rapid demographic transformation, as it enables corporations to hire on mass and for people to relocate on mass. Low interest rates are great for new money and upward mobility, assuming that one does not get into bad debt before a rate hike cycle. A low interest rate environment also enabled special low interest DEI bank loans for people of color to buy homes and start businesses, that are not available to Whites. Higher interest rates will have much less of a negative impact on the more established wealthy, who are disproportionally White, though the White middle and working class will not fare well this recession. While it is inevitable that America will have a more diverse upper class, due to both high skilled immigration and diversity programs, higher interest rates and a credit crunch could very well slow down this trend. There is this meme that woke is a product of low interest rates, which is true though exaggerated, so expect more Dark Powell memes. However, prolonged higher rates could wipe out a large portion of small businesses, and are overall bad for the middle class.

Dark Powell

There was already stagnant growth for Silicon Valley venture capital during the peak of the covid bubble, before the mass layoffs and Silicon Valley Bank crash. While there was tech innovation in the early 2010s, though mostly smart phone/iPhone technology, since about 2015, tech has mostly been in a bubble due to Fed policy and data mining. There is currently hype for an AI boom bringing tech entrepreneurs back to the Bay Area, which deserves healthy skepticism. While there will be a lot of future growth in tech and AI, these industries are becoming more geographically dispersed. Tech’s center of gravity is shifting, with fast growing tech hubs such as Miami and Raleigh NC, and even New York and DC attracting a lot of Bay Area talent. However, it is a stretch to say that Silicon Valley will become the new Detroit. A lot of tech workers are being lured to non-tech industries, including healthcare, which are more geographically dispersed. This is the silver lining of the tech crash, as cognitive talent has been wasted on designing apps that contribute little to civilization, and is overall good for a healthier diversified economy

source: Washington Post

To be continued

.