I have been following financial commentator, Peter Schiff, since the Ron Paul movement and his Senate run. Schiff was one of several, including Michael Burry, to forecast the 08’ financial crash. Now he is predicting a Depression that will be much worse than the 1930s. That is because it will be inflationary rather than deflationary. He was also right to call out the bullishness as bullshit, during the peak of the post-pandemic bubble. He has been consistent with his message while other bears have pivoted after some new data that appeared bullish. However, he is flat out wrong in his call for middle class austerity to fight inflation and reduce the deficit.

Source: @PeterSchiff Twitter

In an interview with the Blaze, Peter Schiff stated that “so if we're going to raise taxes at all, if we really want to you know reduce the deficit with tax increases, we'd have to raise taxes on the middle class because those are the people who are spending money, and we need to reduce consumption not investment if we want economic growth.” His justification for soaking the middle class rather than the rich is that “when you raise taxes on the upper income earners in addition to reducing their incentive to earn money in the first place, you are taxing the money that they might otherwise have invested. You see people that earn a lot of money, they buy whatever it is they want, the money they don't spend is what's left over, and that's the money that's used to grow the economy, that's where Capital comes from, that's how businesses grow, that's how they hire people. Well if you raise taxes on the upper income earners all you do is you diminish their ability to invest and grow the economy.” Schiff has called for a national sales tax, as well as cutting middle class entitlements, such as social security, countless times on his podcast.

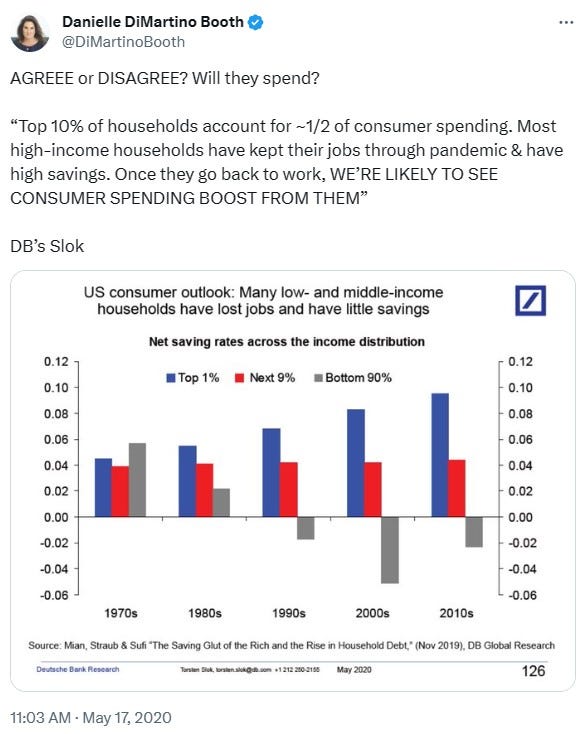

Source: @DiMartinoBooth Twitter

While Peter Schiff is usually spot on with economic data, he is wrong that the wealthy are not primary drivers of inflation. Economist and former adviser to the president of the Dallas Fed, Daniel DiMartino Booth, rebukes Schiff’s argument, pointing out that the stealth stimulus that stoked consumption only benefited the top 20%. The top 10% of households account for about half of consumer spending (Deutsche Bank data), as wealthy Americans are still spending big. This has propped up GDP stats, delaying a technical recession which is also inflationary. This means that Fed rates will have to stay high longer. Overall, it is lower and middle income consumers that are now polling back on spending.

Daniel DiMartino Booth has mentioned that whenever she visits Paris’s Champs-Elysées, its packed with wealthy Americans splurging on luxury goods. Basically, they are spending the accesses of pandemic loans, bank bailouts, and defense contracts. Tom Barkin, president of the Federal Reserve Bank of Richmond, pointed out that “Wealthier folks are still spending, especially on international travel, blowout entertainment and other services and experiences.” Travel impacts energy costs, plus the wealthy spend much of their income on real estate, as shelter is a huge part of the CPI. Schiff is partially correct that wealthy consumers have less of an impact on food costs, though the rise in food costs is linked to energy costs as well as price gauging. In contrast with Schiff’s call for austerity, which is hedging on an hyperinflationary scenario, Booth predicts a deflationary crash.

Consumer expenditure by income

Source: WSJ via Labor Department data

There are two angles to fighting inflation, one is saving the dollar and the other is that inflation is a regressive tax. If inflation is bad because it is a regressive tax, then why enact austerity with a regressive national sales tax on the poor and middle class. If the objective is to save the dollar, then those responsible for devaluing the dollar and creating the debt must be held accountable, not those who are already struggling. Monetary policy is rigged to prop up oligarchs and large institutions. The wealthy benefit the most from the Fed printing, while ordinary people were gaslit that their measly stimmie checks were responsible for inflation.

There are also flaws with Schiff’s argument that taxing the rich is bad because it hinders their potential to invest. Since the pandemic, the wealthy have more disposable income than likely ever, while liquidity is drying up for small businesses and ordinary people are struggling. Even though Schiff was staunchly against the bailout of the wealthy, it shows the failure of trickledown economics, which he defends. If anything, raising taxes on the wealthy could ease inflation in housing, as the rich invest the most of their wealth in real estate. Not to mention that fed rate hikes also stoke rental inflation. However, I agree with Schiff that a luxury tax on conspicuous consumption should be enacted rather than taxing labor.

US Wealth by income bracket

Source: Coalition for a Prosperous America

If Schiff is right that a major financial or dollar crash is inevitable, then it is important for the middle class to hold onto their assets like real estate. Austerity would just hasten the Great Reset, that libertarian financial gurus warn against, as oligarchs would scoop up the assets of the middle class. If Schiff is right that we are facing this inflationary depression, then middle class austerity might not be enough to save the dollar. Rather it would just delay the inevitable while the middle class will own nothing. Schiff has also said that defaulting on the debt is the lesser of evils than inflating away the debt, though he predicts the latter as austerity is not politically palatable.

While populists, on both the left and right, tend to focus on what is moral and who is to blame, there is an argument that austerity is sometimes the only option when a nation is flat out broke. Regardless, there is a distinction between libertarian and populist economics. The main flaw with libertarians, like Peter Schiff, who call for a return to a true capitalism, is that this purer capitalism lead to where we are now, which you could call crony capitalism, late-stage capitalism, or state capitalism. Basically private sector elites built up their wealth under a purer form of capitalism. Then they used that wealth to rig the political system against the competition, as well as use monetary policy to enrich themselves.

In contrast with libertarians, populists tend to support using something like Lincoln’s Greenbacks to pay off the debt, and believe that ending or restricting usury is the key to preventing austerity. While libertarians make valid points that corrupt financial practices, like fractional reserve banking, is enabled by state policies like moral hazard, their shortcoming is letting the private sector off the hook. Not to mention that Schiff opposes anti-trust for Amazon, failing on the centralization vs decentralization spectrum, which is more important than public vs. private. Government creates these monopolies more so than innovation, so why should free-marketers defend them?

The Neoliberal revolution that replaced the New Deal paradigm “evolved”, as extreme austerity for the poor and middle, with tax cuts for the wealthy was too austere, and just not politically viable. Plus oligarchs wanted the stimulus from printing. Some hybrid of neoliberalism and Keynesianism emerged, that involved the Fed printing to prop up the stock markets but also maintain a social safety net to bribe the middle and lower classes, while keeping finance deregulated. While this hybrid began under Alan Greenspan, who was a protégé of Milton Friedman but shifted towards Keynesianism, it really took off after the 08’ recession with Obama and especially during the pandemic. Modern Monetary Theory and Reaganism are twin ideologies of the economic elite. The former appealing to Silicon Valley and Wall Street, who are dependent upon stimulus, while the latter appeals to sunbelt industry, who are dependent upon low taxes and deregulation.

Despite Moody’s downgrading the outlook on the US Treasury to negative from stable, Morgan Stanley’s economists are still predicting a soft landing, Goldman Sachs forecasts no landing, and UBS thinks that the U.S. economy is headed back to a Clinton-like era of the bustling 90s’. You know we are screwed when Larry Fink is saying that fear is driving us into a recession and that all the economy needs is hope. It is important to remember that hard landings are often preceded by the rising popularity of the soft landing narrative.

Source: @TheMaverickWS Twitter

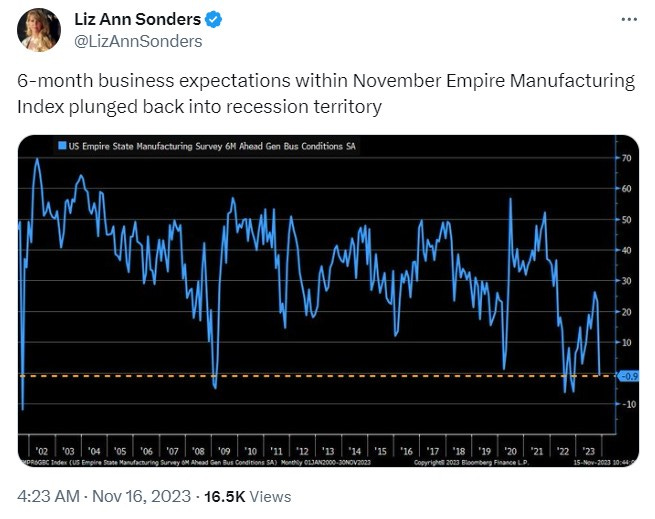

An explanation for the soft landing illusion is that inflation went down while unemployment remained low. This was due to the bank bailouts offset by Biden depleting US petrol reserves that temporarily eased inflation, businesses retaining workers because they are too expensive to retrain, the lagging effects of interest rate hikes to do damage, and pandemic savings, which are now close to being taped out. Schiff says don’t be “fooled by Oct.'s flat #CPI. It's just one month and it was only .1% lower than expectations. YoY headline is still 3.2% and core is still 4%. The #inflation numbers have been bottoming and future CPI numbers will be much hotter, even as the economy cools. #Stagflation!” Even recent stats that show decent GDP growth are explained by mass migration, increased spending via debt, and perhaps fudging the numbers via inflation. Also the stock markets are propped up by just 7, primarily big tech stocks, which are interest rate sensitive. However, current economic signals look much more bearish, such as the biggest spike in unemployment since covid, credit card debt at an all-time high, and rising corporate defaults.

source: @LizAnnSonders Twitter

While the 08’ recession/financial crisis was primarily due to bad home loans, right now there are several big economic problems, the big one being unprecedented levels of debt, that will create the perfect storm. For instance, China’s financial crisis, as China’s rapid economic growth helped prevent a global recession in the late 2010s, and commercial real estate, which is already suffering due to remote work, and will have to be refinanced at higher interest rates, which will take down many more banks. Other problems include the return of student loan payments, potential mass worker strikes, the Fed’s balancing act between inflation and interest rates, energy issues due to both foreign affairs, as well as the shale industry being sensitive to high interest rates. Quantitative easing and stimulus won’t be a viable solution for the recession, as with 08’or the pandemic, due to inflation.

Source: @PeterSchiff Twitter

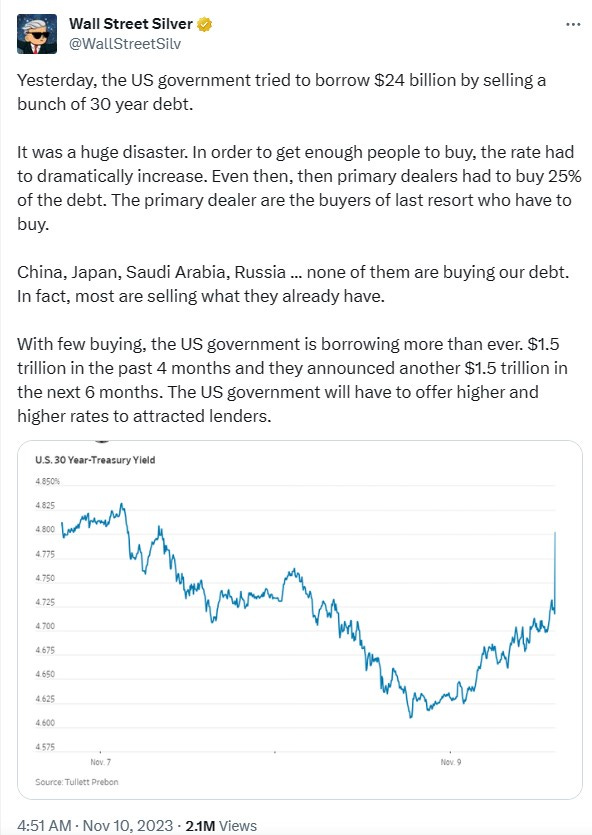

Peter Schiff has been predicting the biggest bond market crash in US history, with bond yields spiking as debt accelerates. Last month, the yield on the 30-year Treasury spiked to over 5% for the 1st time since 2009, though went back down due to markets hedging on no more Fed hikes. However, once bond markets factor in that interest rates will have to be high for longer, yields will spike through the roof, especially if inflation resurges. Schiff explains that “Investors still don't get that long-term bond yields are out of the Fed's control. Even if the #Fed decides to pivot to prevent yields from rising too much, rate cuts and a return to QE will cause the #dollar to sink and #inflation to soar. That scenario is bearish for #bonds.” Unprecedented levels of debt will make a bond market crash much more catastrophic for the financial system. If bond yields continue to spike, there is a greater risk for more bank failures.

The primary use for U.S. dollars overseas has been to buy US Treasury bonds, so debt creditors raising rates has a greater impact than the Fed’s rate hikes. Creditors tend to buy less bonds in recessions, plus there is a danger of a mass selloff off in bonds by foreign creditors, like China, Japan, and Saudi Arabia. Hedge Fund manager, Ray Dalio, declared that “America is facing a debt crisis as there may not be enough buyers for the influx of government debt on the market, per Fortune.” Schiff also predicts that “a slowing #economy will actually cause #inflation to speed up. That's because as the economy slows budget deficits will rise and the #dollar will fall.”

Source: @WallStreetSilv Twitter

The war in Israel/Gaza, especially if it escalates into a broader regional war, will add more liquidity to markets, and delay a credit crunch. Basically, like with covid or the Ukraine war, will be simulative in the short term but will increase inflation and debt long term, so the big crash will be much more catastrophic. There is also potential for disruptions to oil supplies, which would be catastrophic for global markets.

The recession will likely start very soon, if we’re not in one already. I predict another wave of fiscal stimulus, in response to the recession. Then another wave of bullishness, as the economy will be propped up before the election, with the big crash likely occurring shortly after the election, unless something really breaks in the bond market. Perhaps Schiff is right about the inflationary depression, as the Fed will likely inflate the dollar, as debt is unsustainable under high interest rates. At the very least we're looking at 1970's stagflation paired with a 2008 banking crisis.

Source: @TheMaverickWS Twitter

This Schiff guy is either a propagandist or stupid. Why on earth would even more payouts to oligarchs help normal people? They don't teach real economics in America

Rightwing apes:

"return to QE will cause the #dollar to sink and #inflation to soar."

We had plenty of QE in the last 20 years. Was any inflation associated with QE? Of course not! But never let facts get in the way of an Austrian economist!

"slowing #economy will actually cause #inflation to speed up. That's because as the economy slows budget deficits will rise and the #dollar will fall.”

Deficits have been going through the roof forever. Has this caused any inflation? Of course not.

Rightwing apes: "Deficits cause inflation!" Durr hurr.

"Quantitative easing and stimulus won’t be a viable solution for the recession, as with 08’or the pandemic, due to inflation."

QE and stimulus didn't cause inflation last time around, why would it now?

Rightwing apes: But this time it will! Durr hurr.

"Schiff says don’t be “fooled by Oct.'s flat #CPI. It's just one month and it was only .1% lower than expectations. YoY headline is still 3.2% and core is still 4%. The #inflation numbers have been bottoming"

Rightwing apes: "Oh noes! 3% inflation is baaaaaaaaaaaaaaaaaad! Inflation! Inflation! Inflation!" All these guys are Chicken Littles!

Sane people: "Inflation is very low. Rightwing apes: "That's because it's bottoming out! Inflation! Inflation! Inflation! My name is Chicken Little!"

"However, current economic signals look much more bearish, such as the biggest spike in unemployment since covid"

Oh noes! It's all the way up to 3.9%! The sky is falling!

"Not to mention that Schiff opposes anti-trust for Amazon"

LOL. You are surprised? He's a rightwing monkey. ALL rightwingers always oppose all antitrust enforcement, period. The pro-antitrust rightwinger does not exist.

"There are also flaws with Schiff’s argument that taxing the rich is bad because it hinders their potential to invest."

The apes always make this argument. It's their go-to.

"Even though Schiff was staunchly against the bailout of the wealthy, it shows the failure of trickle-down economics, which he defends."

Of course he defends it. He's a rightwing monkey man. They always support trickle-down economics, despite the fact that it's never worked anywhere ever, not even one time. MOST rightwingers are dishonest by their nature.

Conservatism means rule by aristocracy and liberalism means rule by the people or democracy, so of course all conservatives always hate democracy. Conservatism must lie to the people and tell them it's about popular rule and democracy when it's really about aristocratic rule because few majorities except probably Moronicans will ever vote for aristocratic rule or rule by the rich. Of course rule of the rich is always bad for the masses. It cannot ever be anything but. The problem with capitalism is that capitalists always support aristocratic rule and always hate democracy or rule by the people. This is a fatal flaw in capitalism, and there is no cure for it ever!

"The main flaw with libertarians, like Peter Schiff, who call for a return to a true capitalism, is that this purer capitalism lead to where we are now, which you could call crony capitalism, late-stage capitalism, or state capitalism."

Libertarians are liars! They support aristocratic rule so they almost have to be liars by definition. There is no "pure capitalism." There's never been any and there never will be. Capitalism is always and only ever crony capitalism. There's no such thing as state capitalism. It's bullshit. Late stage capitalism is simply what we've had for decades now.

"Then they used that wealth to rig the political system against the competition,"

How on Earth did capitalists rig the system against competition? This sounds like libertardian bullshit. Libertardians complain that the state rigs the system against competition. The truth is that all capitalists hate competition. The only ones who want to use antitrust are those who are behind in the game. They want to dethrone the monopolists so they can become monopolists themselves. Basically everything a capitalist says is a lie. This is another huge problem with that system.

"Government creates these monopolies more so than innovation, so why should free-marketers defend them?"

Because all free-marketeers care about is money! Real simple.

"If Schiff is right that we are facing this inflationary depression."

There's no such thing. If it's inflationary, it's not a depression and if it's a depression, it's not inflationary. Real simple.

"Austerity would just hasten the Great Reset, that libertarian financial gurus warn against, as oligarchs would scoop up the assets of the middle class."

"However, I agree with Schiff that a luxury tax on conspicuous consumption should be enacted rather than taxing labor."

Good luck with that. No Republican will ever vote for this.

There are two angles to fighting inflation, one is saving the dollar and the other is that inflation is a regressive tax. If inflation is bad because it is a regressive tax, then why enact austerity with a regressive national sales tax on the poor and middle class.

LOL since when did any conservative care about regressive taxation? Answer? Never.

"The wealthy benefit the most from the Fed printing, while ordinary people were gaslit that their measly stimmie checks were responsible for inflation."

This part is actually correct. I can't believe how many "leftwingers" fell for the "Stimulus caused inflation hurr durr!" BS. Pathetic.

I guess the Great Reset already happened, but this is what occurred in the pandemic.