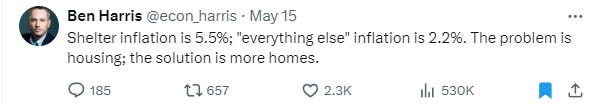

Higher interest rates have not been effective at fighting inflation because our economy heavily revolves around real estate while Fed policy is still geared toward the manufacturing-based economy of the past. A lot of the higher CPI metrics for inflation are due to shelter costs.

Higher interest rates slow down new construction and discourage home buyers from selling, thus driving up housing and rental inflation. Corporations also pass down the cost of refinancing at higher interest rates to consumers. However, there is still a risk that rate hikes will cause a crash in commercial real estate. The solution to inflation is not more rate hikes but rather cutting spending, especially among public employee positions, increasing capital gains taxes on the ultra-wealthy, increasing energy production, and increasing the housing supply.