Santiago Capital CEO, Brent Johnson’s, Dollar Milkshake Theory is that “there simply aren't enough US dollars created to keep up with the rising demand. And when the greenback rises high enough and fast enough to lead to defaults abroad, the demand for dollars swirls up and its supply shrinks, leading to an epic squeeze higher.” Basically, the higher Dollar puts pressure on foreign currencies and economies because people want dollars due to other people wanting dollars, as Johnson explains. The US Dollar’s monopoly as the World Reserve Currency creates a trap that is analogous to how a corporation that is a monopoly can get away with poor practices and services. This is as much the case as America’s military and economic power.

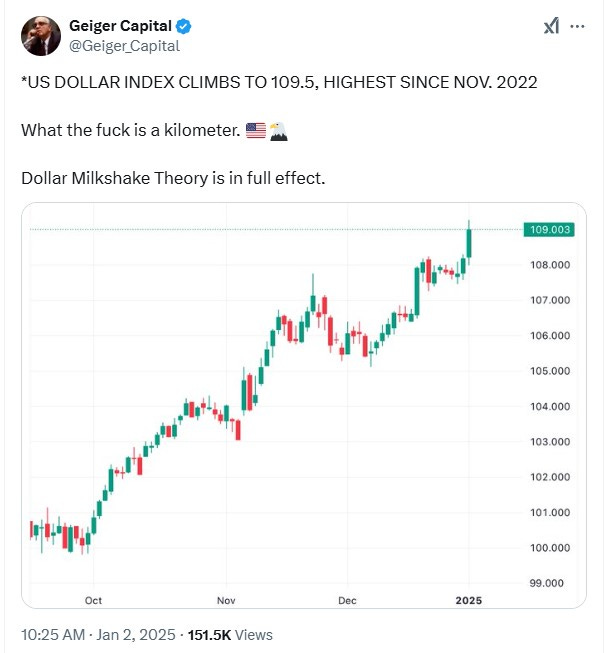

source: @Geiger_Capital on X

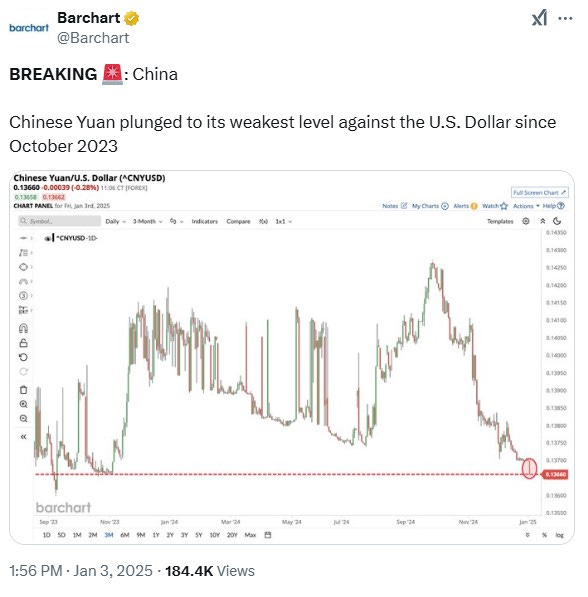

The Dollar has surged recently due to Donald Trump’s tariff proposals and because the Fed signaled that there will be fewer rate cuts than previously anticipated. However, Dollar markets had previously been relatively stable. Brent Johnson predicts that if the Dollar does not stop rising soon, there will be some real problems for the global economy. For instance, Brazil’s and China’s currencies are crashing while Russia’s, Mexico’s, India’s, and South Africa’s currencies are also at risk, due to the Dollar surge. Economies like China have been able to hang in there, but any further spike in the Dollar could push any of these economies over the edge. China has propped up a lot of other economies from Canada to Australia, and plenty of Third World nations in Latin America, Asia, and Africa.

source: @Barchart on X

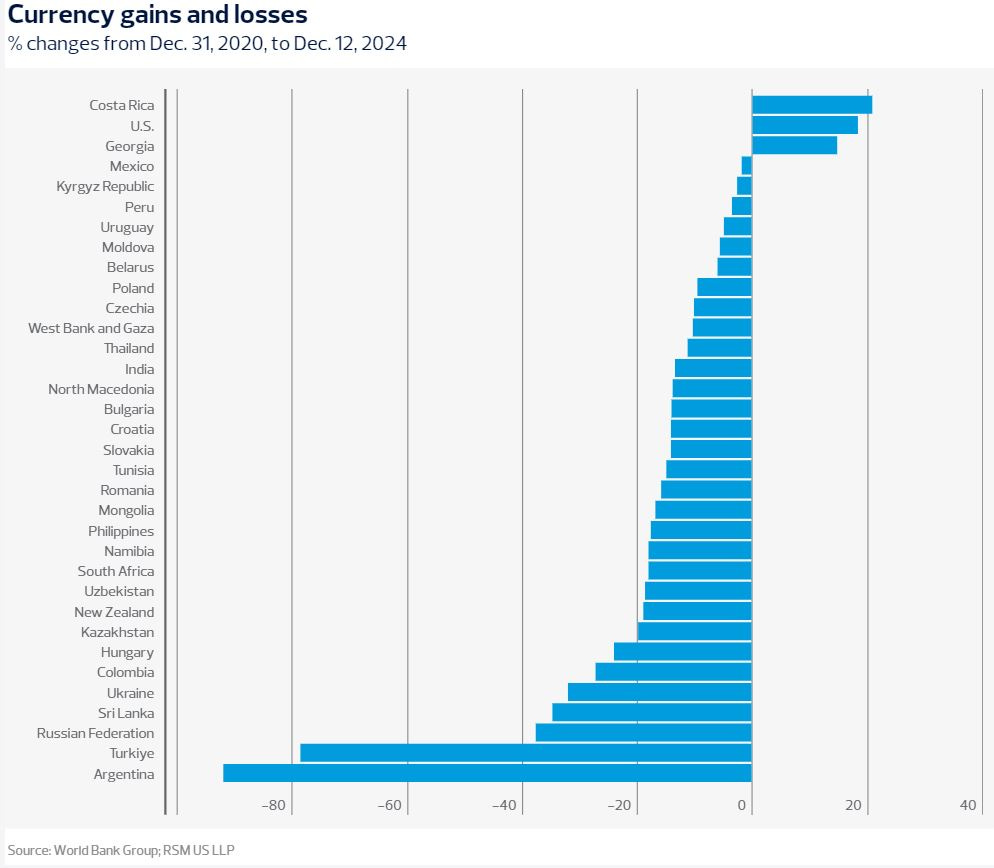

source: @IvoPan145365 on X

Since the 2008 Financial Crisis and again during the pandemic, the Fed’s money printing has injected tons of liquidity into global markets, which has propped up the rest of the World’s economies. However, the Fed’s tightening cycle to curb inflation is putting a major strain on foreign economies by creating Dollar shortages. While the US is cutting interest rates, the rest of the World is also cutting rates. When foreign countries can’t afford to pay off debts denominated in Dollars, they devalue their currencies to pay off their debts. By devaluing their currencies they only further strengthen the Dollar.

source: The Real Economy blog via World Bank Data

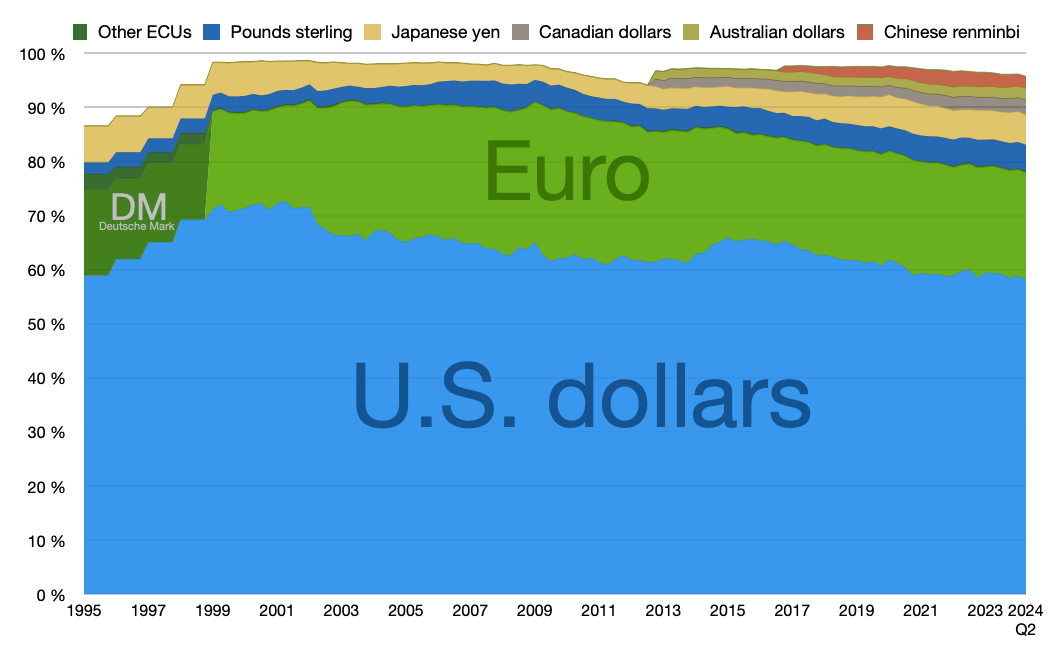

While the US could eventually lose its Reserve Currency status, I do not see that danger anytime soon, as there is no viable competitor. The US Dollar usurped the British Pound Sterling because the US vastly surpassed the UK, which was bankrupted by WII. In contrast, US hegemony has been greatly strengthened due to energy independence, weakening Russia, and winning the AI race against China. This is even taking into account the process of de-globalization, into different geopolitical spheres, which will harm China much more as an exporter to the West. The big question is whether the Dollar causing a massive global economic collapse could entail some future process of de-dollarization.

source: Wikipedia.org

While Modern Monetary Theory may not be sustainable forever, it has worked at propping up the economy since the 2008 crash and after the pandemic. The US becoming energy independent and the Dollar being stronger than other nations’ currencies explains why inflation has declined from its peak a few years back. The counterargument to the dollar milkshake theory from Austrian Economists is that the US will have to devalue the Dollar to pay off its massive deficit. However, so far these Austrian perma bears, like Peter Schiff, have been wrong in predicting that US money printing is endangering the status of the Dollar. This is because the US exports its inflation to other nations via capital outflow. Austrians are also wrong in that other nations going off fiat and backing their currencies with gold, or some other commodity, is not guaranteed to save their currencies.

Trump in the past has said that he wants a weaker Dollar, to make it cheaper to bring back manufacturing, much like China has devalued their currency. However, Brent Johnson makes the case that a weaker Dollar does not jive with Trump’s proposed tariffs. This is because tariffs entail that foreign trading partners will receive fewer dollars for their commodities, creating scarcity in dollars for global markets, further increasing the price of the Dollar. This also explains why US sanctions on Russia did not lead to mass de-dollarization, as many had predicted, but rather increased the value of dollars by making them more scarce. Johnson also thinks that Trump’s tariffs will offset any impact of Fed rate cuts on the Dollar. Even if Trump delays implementing tariffs, Dollar markets respond to predictions on future policy. Not to mention that Trump has less qualms fucking over other nations.

Despite many economic problems and vulnerabilities, the US’s economic advantage is that it is much stronger than other nations’ economies. This is why Brent Johnson is much more worried about overseas economies than the US economy. Even if America’s economy is in bad shape during a potential global economic crisis, the Dollar will be further strengthened. This is because the worse off other currencies and economies are, the more they need dollars, increasing the value of the Dollar. This would create a cycle like a Chinese finger trap, where the Dollar being even stronger would further crush other nations’ economies.

Other nations’ economies being harmed by a Dollar surge could have a ripple effect back to the US economy, as other nations can’t afford American products. However, a strong Dollar can depress the prices of other nations’ commodities, which brings down inflation for Americans. Not to mention that foreigners will look to the Dollar and US investments as a hedge. I was a perma bear since the pandemic, but I was wrong in that markets have been very bullish and the US has avoided a technical recession. However, a strengthening Dollar could be the catalyst that sets off a major global financial crisis.