Fed’s attempt at Goldilocks Scenario (Soft Pivot) will crash the Economy

Powell & Yellen flipflopping on Rate Hikes and Bank Deposits signals greater Volatility

Yesterday, the Fed raised interest rates by .25 basis points, as the Fed did in February before the banking crisis. I speculated that a bank scare could cause the Fed to pivot, but this modest rate hike did not surprise me, as the CPI came in at 6% inflation for February, and there are signs of the Dollar’s value being eroded. This rate hike was also in light of treasury secretary, Janet Yellen’s, remarks that the U.S is “not considering 'blanket insurance' for bank deposits.” While stocks went down yesterday, in response to Yellen’s remarks on bank deposits and the rate hike, stocks rallied today, because Fed Chair Powell hinted at a pivot. These “Jack Nicholson” rallies show how much desperation and greed there is in the markets, as well as the copes to prop up this mega bubble. Especially taking into account the lack of trust and certainty in the Fed’s decisions and overall economic volatility.

Stock Market rallying in hope of a Fed Pivot

Powell flipflopped on rate hikes, from saying that “We do next expect to cut rates this year,” yesterday, and that he considered a pause in rate hikes but that the hike was supported by strong consensus, but also said that the “Process of getting inflation back down has a long way to go,” and that “It will be bumpy.” In regards to a soft landing, Powell said that “We'll just have to see... I still believe that pathway exists [to a soft landing] and we are trying to find it.” Both Powell and Yellen have also been backtracking on insuring bank deposits. For instance, yesterday Yellen said that “We are no longer considering backstopping all deposits,” but the day before she said that “We are considering backstopping all deposits.” Today, Yellen did a total U-Turn in stating that “prepared for additional deposit action if warranted.” Yellen removed this language, while speaking to the Senate Subcommittee today, "As I said last week, the U.S. banking system is sound." Powell also said that "Depositors should assume their deposits are safe,” which does not sound very reassuring.

Last week, in an exchange with Republican Senator, James Lankford, when asked "Will every community bank ... get the same treatment as SVB?" Yellen stated that, "Banks only get the treatment if ... the failure to protected uninsured depositors would create systemic risk." So basically the plan is to let smaller regional banks get wiped out by rate hikes, with no assistance, then just use inflationary Quantitative Easing, to prop up the “too big to fail” banks, and then hope consolidation happens smoothly. Obviously letting all of the regional banks crash, could trigger bank runs, risk a total collapse of the financial system, and is overall very risky and a huge gamble. Zerohege reported that “Every day the Fed is paying the LARGE banks and money markets $650MM in interest on reserves and reverse repos ($700MM tomorrow). Meanwhile, the small banks are hemorrhaging billions in liquidity and are about to shut lending activity due to a deteriorating reserve shortage.” An astonishing $11 Trillion has already exited the most vulnerable banks, and it would not surprise me if a few more regional banks go bust over the next few weeks. Moody’s credit agency just said “there is a risk that US banking 'turmoil' cannot be contained.”

Powell has expressed openness to the possibility of a pause, after another .25 rate hike in May, and at least two more rate hikes are anticipated by the markets. I don’t expect the Fed to drop rates anytime soon but a pause is likely. However, a lot depends on both whether inflation increases and the severity of the financial crisis. Basically, the Fed is playing catch up on rate hikes, as there was a narrow window to stop inflation without crashing the economy, perhaps in early 2021. However, it is too late for any kind of soft landing scenario, and the Fed does not have any good options left. Powell has no coherent plan, and is basing rate hikes on where the economy is short term.

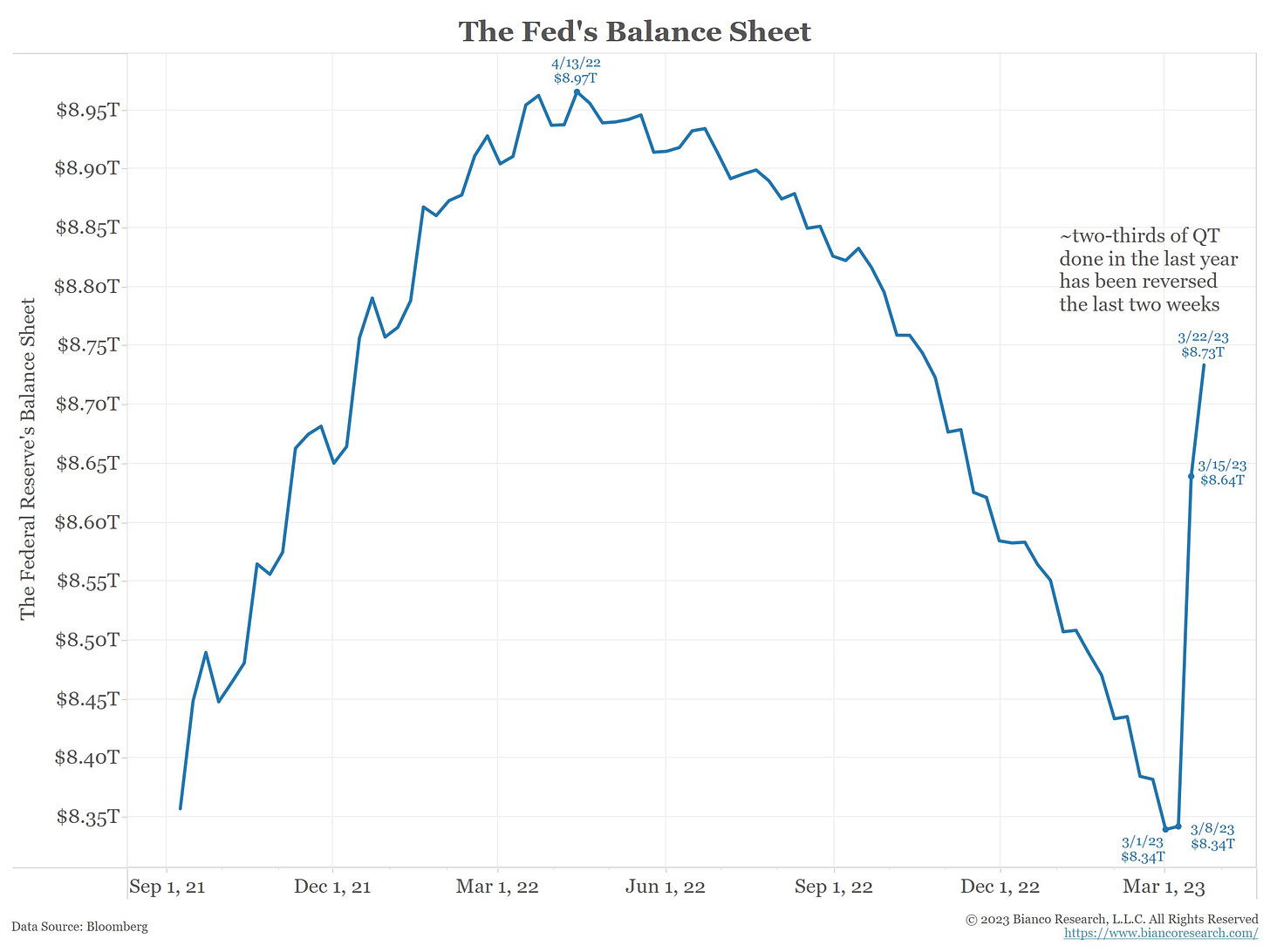

As for my point from the previous article about the Fed’s two choices, a pivot that causes inflation to soar or more rate hikes that cause a financial collapse, it looks like the Fed is going for some kind of goldilocks scenario, or soft pivot. For instance, both hiking rates and tightening the financial markets plus a return to QE causing more inflation, or a balancing act of fighting inflation while still trying to save the big banks and prop up the bubble. This middle ground could end up being much worse than either quelling inflation with high rates or letting inflation soar to make debt cheap. That nightmare scenario of an Inflationary Depression, that Peter Schiff warned about, is not the most likely scenario but could happen if the Dollar crashes, and we are stuck with the debt. Besides the two extremes of hyperinflation or a deflationary Depression, the most likely goldilocks scenario is probably a severe recession, followed by long term stagflation, which is far from the new cope of a soft recession.

Come on. This panic-whipping articles serve no constructive purpose.

1. There are plenty of fiscal tools (higher taxes, lower gov spending) to tame inflation without raising interest rates. 2. Higher interest rates per se are good for banks' core business, not harmful. 3. The depositors' flight we've seen this month is due only to fear-mongering by the press and irrational behavior after a couple of insanely-managed banks went bust because of their exceptional, individual circumstances. 4. The Fed two weekends ago enacted strong measures to ensure banks have short-term liquidity; with these, even SVB would not have gone bankrupt.

This nothingburger "crisis" will end as soon as the mass media move on and drop the scary headlines.